In October 2024, petroleum coke prices are reflecting a complex mix of market influences, including fluctuating demand, supply chain constraints, and the impact of recent policy shifts. This analysis examines these key factors and provides an updated view of current pricing trends. By breaking down the primary drivers behind recent price changes, this report offers insights into what may shape the petroleum coke market in the coming months.

Petroleum Coke Market Overview

We do not analyze the price for petroleum coke during Chinese National Day holiday as usual.

Overall, petroleum coke market performs more strongly than the September 2024.

Concretely speaking:

In the first week, petroleum coke market traded actively after Chinese National Day holiday. Downstream enterprises had a stronger purchasing enthusiasm than previous several weeks whatever for low sulphur or high sulphur. After the holiday, the price for petroleum coke has increased generally. It is noted that carbon industry played a key role in supporting the price for medium and high sulphur petroleum coke. Compared with the last week, price had a slight increment.

In the second week, price for petroleum coke market still kept rising. Additionally, compared with the last week, demand for downstream enterprises rising instead of falling. Meantime, supply is also moving in a positive direction. These factors had a positive impact on the price and made it stable and rose. No matter it is low sulphur, medium sulphur or high sulphur, all have changed the past decline. The increase hit a record high in recent months.

Retrospecting the third week, petroleum coke market trade was differentiated slightly. For high sulphur petroleum coke, as the enough supply, its price had a small falling trend. Fortunately, everything was under control. Despite it differentiated slightly, average price for petroleum coke market still at a relative high level. And it was about 248 USD/MT.

In the last week of October, market changed hardly, compared with the previous week. Demand of downstream enterprises was not stronger than several weeks ago and some of refineries had to reduce the price, in order to maintain the petcoke market stability. While, it is noted that average price for petcoke market was still increased slightly.

Fig. 1 Average Price

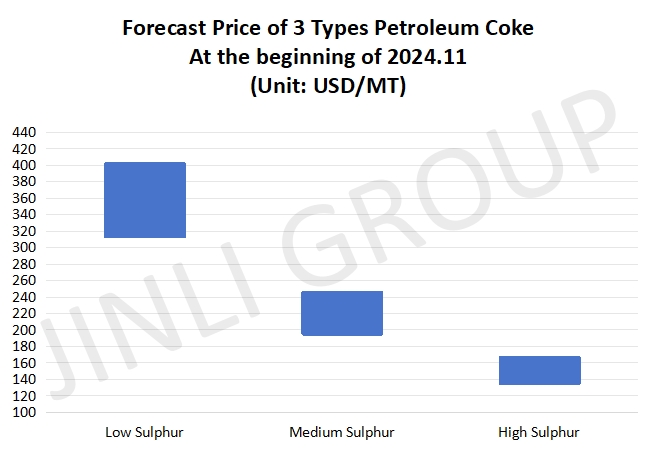

Fig. 2 Forecast Price

Forecast Price for Petroleum Coke

Supply:

According to the information we have, some equipment that stop producing will be ready to reopen and resume the production at the beginning of November 2024. And maybe some refineries will reduce their yield. While, overall, the yield of petroleum coke will be relative stable.

Demand:

In general, demand for downstream enterprises will be similar to several months ago. Most of them purchase petroleum coke according to their orders. As the demand for graphite electrode downstream enterprises performs weakly, they have a weak purchasing enthusiasm for petroleum coke. Fortunately, it is limited for the effect of petcoke.

In summary, it is limited for supplying to support the petcoke market in a short term. However, some downstream enterprises will replenish their inventories and it is conducive for supporting the price. Thus, we anticipate the price for low sulphur have a rising trend at the beginning of November 2024. And price for it ranged from 313 USD/MT to 402 USD/MT. For medium sulphur, its minimum price is about 195 USD/MT. As for high sulphur, the price is no more than 167 USD/MT approximately.