By December 2024, the petroleum coke market has faced continued price increases and fluctuations. And it influenced by supply, demand and broader economic conditions. This analysis examines the key factors that have driven price up throughout the December and provides a summary of market trends. What’s more, this analysis also looks ahead and offers insights into potential challenges and opportunities that could impact on the petroleum coke market as we move into 2025.

Petroleum Coke Price Overview

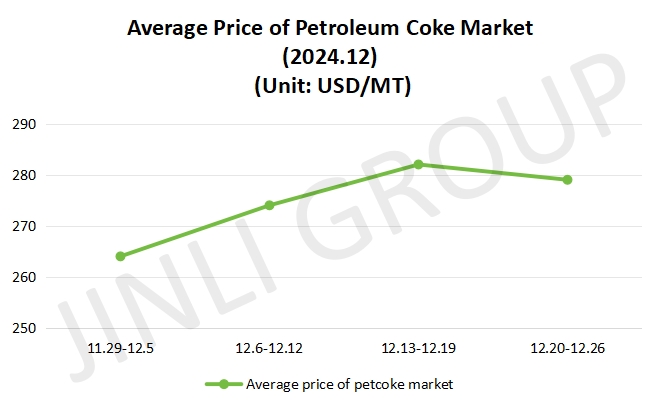

Overall, the prospect of petcoke market is optimistic. In December 2024, price trend continues the previous good momentum. From figure 1, we can see clearly that petroleum coke price still maintains growth momentum.

Concretely speaking:

In the first week, petroleum coke traded actively and its price continued climbing. As we all know, for almost all products, supply and demand are the major factors that impinged on the price, petroleum coke is no exception.

Market supply is tight, it means that whether in main refineries or local refineries, it is difficult for produced petcoke to meet the needs. At the same time, downstream enterprises procured the products with a stronger purchasing enthusiasm. Due to these changes in supply and demand side, it drives petroleum coke price up significantly.

In addition, its average price reached 264 USD/MT approximately and increased by 3.3% nearly.

In the second week of December 2024, supply and demand sides still performed strongly. It traded warmly. As a result of strong purchasing enthusiasm for downstream enterprises, in addition, there were fewer spot resources and inventories. These crucial factors impact on the price together and made it surge.

For imported coke, its situation was similar, namely price rose simultaneously. For low sulfur petroleum coke, some local refineries adjust the price accordingly followed by main refineries.

Overall, price trend kept rising momentum and we did not see any signs of falling, at least at the beginning of December 2024.

For the third week, petroleum coke market still performed strongly and continued rising momentum.

Downstream enterprises purchased petroleum coke largely and inventories of main refineries at low level. Thus, it pushed prices up during this week. For low sulfur or medium sulfur petroleum coke, its price changed by main refineries adjustment. As for high sulfur petroleum coke, it is easy to sell without any pressure and most of them continued increasing.

Compared with the second week of December 2024, petroleum coke price increased about 9 USD/MT.

In the last week of 2024, the situation was different. Compared with previous several weeks, growth momentum of petroleum coke price was slowing down and market showed a divergent performance.

For downstream enterprises, their purchasing enthusiasm for low sulfur petroleum coke was still relatively strong. However, at present, rising costs have introduced some pressure and caused cautiousness in accepting orders with high price. Thus, the price increase for low sulfur petroleum coke has slowed down during this week.

On the other hand, for some local refineries petcoke, its price reached the bottom and rebounded slightly. Overall, petroleum coke price downed to 280 USD/MT approximately.

Fig.1 Average Price

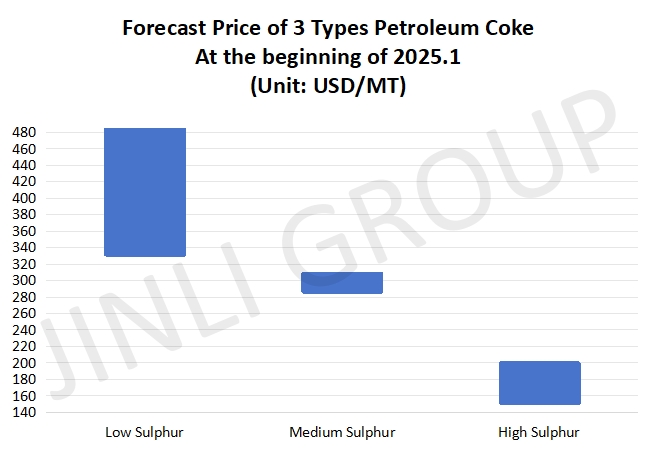

Fig.2 Forecast Price

Petroleum Coke Price Trend

For domestic petcoke, according to insider’s words and information we have, there is a slight increment of production at the beginning of New Year. Albeit the supply will be rose, it is limited.

On the other hand, imported coke is another scene. Delivery speed for petroleum coke remains high in plenty of ports, resulting in petcoke stockpile in ports have a downward trend.

What’s more, recently, the number of petroleum coke that transported to ports is less. And it is also one of the main factors that affect the stockpile in ports.

As the New Year approaches, various downstream enterprises have different attitudes for procuring raw materials.

Most of downstream enterprises have a strong waiting mentality and it means they do not purchase it in bulk at this moment. Of course, there are also some exceptions.

For example, some downstream enterprises, like carbon industry and anode materials industry replenish their inventories before the New Year usually. While, influenced by weak market profit, purchasing enthusiasm is not very strong.

Except for these, it is prudent for other downstream enterprises to procure raw material during New Year holiday.

Conclusion

As we narrative above, it is limited for downstream enterprises to purchase petroleum coke due to weak market profit. However, demand is not changed a lot. Hence, they still maintain just-needed purchase at the beginning of 2025.

For low sulfur petcoke, it still has a upward trend, but the increase will not be as large as before. As for medium and high sulfur petcoke, its trend is still mainly stable. And small fluctuations within 14 USD/MT are not ruled out.

In summary, low sulfur petroleum coke price ranged from 330 to 485 USD/MT approximately. Maximum price for medium and high sulfur petroleum coke is no more than 310 USD/MT, as figure 2 shown.

If you have any needs, please contact us without any hesitation!