As we delve into the second month of 2024, the petroleum coke market continues to navigate through the turbulent waters of supply and demand dynamics. Building upon the trends observed in the previous month, this analysis aims to dissect the factors influencing price fluctuations and offer a comprehensive overview of the market landscape.

Petroleum Coke Market Overview

It encountered the Spring Festival just right in February,2024. Due to this reason, we will analyze data in February except for the first and second week merely.

Petroleum coke market is stable and improving during the whole February. Concretely speaking:

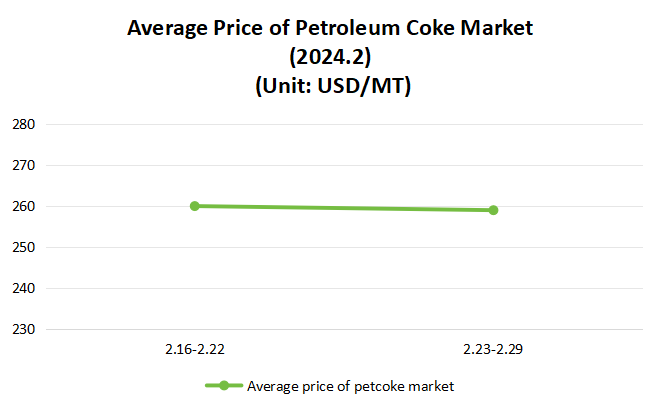

In the third week(2024.2.16-2024.2.22), petcoke market has shown increasingly steady trends. Compared to petroleum coke market in the early of February, some downstream enterprises had a stronger purchasing enthusiasm for it, especially at the end of the Spring Festival. Furthermore, petroleum coke inventory for refineries stayed in low level for a long term. Due to these factors, it is beneficial for petcoke price to rise. Nevertheless, as we known, price is always under the fluctuation. As price for petroleum coke climbed unceasingly, some downstream enterprises for carbon industry appeared the loss. Subsequently, their purchasing enthusiasm was more and more weak naturally and they procured it according to their orders. At this moment, price for petroleum coke stopped rising successively.

At the end of February, petroleum coke market for different sulphur content started to polarize. For low sulphur, it traded moderately, even price was dropped for some refineries; For medium and high sulphur, it was another scene——price for them rose continuously in some local refineries. Otherwise, average price for petroleum coke market cannot be similar with the last week almost, that is about 259 USD/MT.

Fig. 1 Tendency chart of petroleum coke price during February 2024

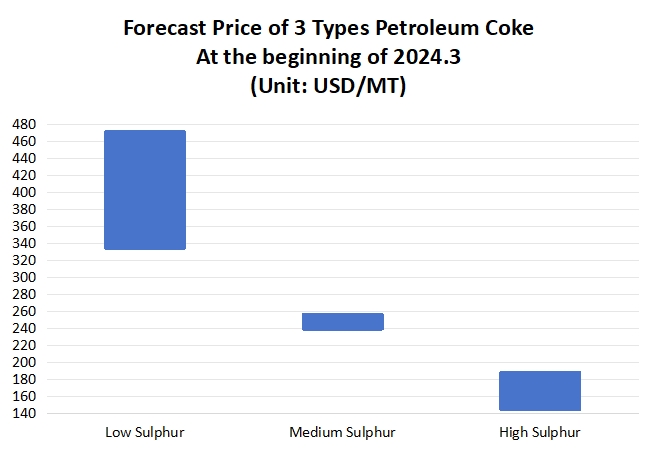

Fig. 2 Forecast of petcoke price at the beginning of March 2024

Forecast Price for Petroleum Coke

Whatever supply or demand aspect, outlook is not optimistic. Yield for domestic petcoke will be reduced due to equipment maintenance. While, some downstream enterprises for carbon industry and anode material is unwilling to procure. Instead, they are more inclined to purchase according to their orders. Likewise, downstream enterprises for graphite electrode have sluggish demand.

In summary, petroleum coke market will be traded moderately and purchasing enthusiasm for most of enterprises is weaker than at the end of February 2024. We forecast price for petroleum coke market will be stable at the beginning of March. We anticipate maximum price for low sulphur will be about 471 USD/MT, minimum price for medium will be 239 USD/MT approximately. And price for high sulphur ranged from 144 to 188 USD/MT. Figure 2 shows price for different sulphur content we forecast.