As we approach the fourth month of 2024, the petroleum coke market continues to experience slight fluctuations in prices influenced by various market dynamics. This analysis provides an in-depth examination of the factors driving the current pricing trends and offers insights into what to expect in the coming weeks.

Petroleum Coke Market Overview

According to convention, we will not analyze the petroleum coke price during tomb-sweeping day.

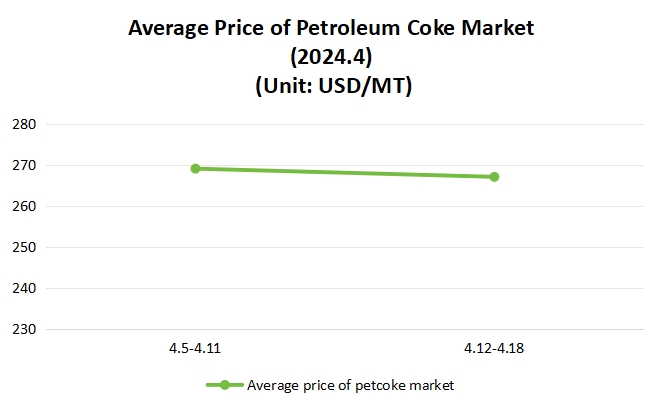

Retrospecting the whole April, 2024, petroleum coke market fluctuated slightly and tend to stable gradually.

Concretely speaking:

From the first half of April, petroleum coke market traded fluctuatingly. Most of medium and high sulphur petroleum coke price climbed. On the contrary, some low sulphur petroleum coke price declined. Market for negative electrode material recovered gradually and the number of order has been increased. It supported price for raw material certainly. For imported petroleum coke, delivery speed kept stable.

From the second half of April, the overall market traded more moderately than the last week. Due to support of downstream market, for example, negative electrode market and stronger purchasing enthusiasm for end user, demand for raw material rose continuously. While, other enterprises didn’t have such a strong purchasing enthusiasm. And they procured raw material according to their purchasing order. For example, carbon industry. Petroleum coke price fluctuated slightly. Average price is about 267 USD/MT and declined 0.52% approximately.

Fig. 1 Tendency chart of petroleum coke price during April 2024

Fig. 2 Forecast of petcoke price in May 2024

Outlook for Petroleum Coke Market

From supply aspect, whatever domestic or imported coke, outlook is optimistic relatively. Imported traders sell the goods actively and delivery speed in port will stay at a high level.

From demand aspect, purchasing enthusiasm for petroleum coke will be strong in downstream industries except for carbon industry. As for graphite electrode market, prospect will be not optimistic. It still performs weakly and is difficult to reverse the situation in a short term. It is prudent of them to procure petroleum coke under such circumstance.

In summary, overall market stay stable and demand for downstream will increase step by step. We forecast petroleum coke price will be fluctuated slightly at the beginning of May 2024. For low sulphur petroleum coke, price is between 290 – 476 USD/MT; for medium sulphur, price ranged from 224 to 256 USD/MT; as for high sulphur, maximum price is about 173 USD/MT.