In May 2024, the petroleum coke market shows continued volatility, with prices influenced by supply chain disruptions and changes in demand. This article explores the key factors affecting price movements and provides insights into future market trends.

Petroleum Coke Market Overview

Likewise, we will not analyze the price for petroleum coke during the holiday of labor day.

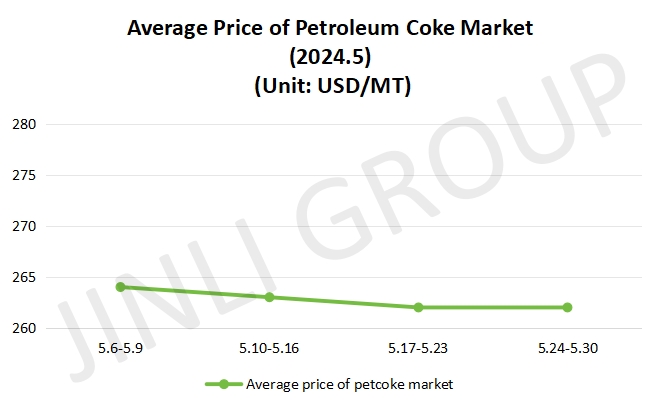

In May 2024, overall, the average price for petroleum coke market is stable, although it tends to decline. From exchange rate, we can see clearly that it between USD and CNY rises steadily under fluctuation.

Concretely speaking:

The first week:

Due to the end of holiday, most of enterprises replenish their inventory as usual. Petroleum coke market traded moderately. A lot of downstream enterprises procure it according to demand. The average price is about 265 USD/MT.

The second week:

Trend looks like the last week slightly. Supply of petroleum coke reduces. Generally speaking, it is conducive for price to climb. However, frankly speaking, it is also affected by downstream demand. Limited by weak purchasing enthusiasm of downstream enterprises, price does not fluctuate sharply, on the contrary, it remains stable from the last week.

The third week:

Price and market for petroleum coke differentiates. For medium and high sulphur petroleum coke, price rises partly for some main refineries. As for low sulphur petroleum coke, it is a different sight. Price for low sulphur reduces partly. It causes all price decrease. In addition, trade market is not optimistic in the past several months and support to price is limited. What’s more, downstream market performs generally and plenty of downstream enterprises are unwilling to procure petroleum coke. Furthermore, merely exchange rate between USD and CNY, it increases 0.3% approximately, compared with the first week of May 2024. Even so, it can not combat with depressing market, the average price for petroleum coke downed to 262 USD/MT.

The fourth week:

Overall market situation is similar to the last week and traded moderately. Under high capital pressure at the end of month, downstream enterprises purchase petroleum coke according to demand. Meanwhile, some refineries adjust the price for coke flexibly. Delivery speed of imported petroleum coke still remains stable.

Fig.1 shows the average price trend in May 2024.

Fig. 1 Average price

Fig. 2 Forecast price

Forecast Petroleum Coke Price

From supply aspect, we anticipate that supply of domestic petroleum coke will reduce slightly at the beginning of June 2024. Most of trade companies purchase it according to their orders.

From demand aspect, as end user demand increasing, for anode material market, perhaps purchase order will increase in the future and demand for raw material will be stable. Looking at graphite electrode market, PO is dispersed and we anticipate that they will be prudent to procure petroleum coke.

In conclusion, at the beginning of June 2024, production of domestic petroleum coke will decrease slightly and it is conducive for petroleum coke market. Although there are signs of demand for downstream enterprises recovered, overall increment is limited, besides, imported petroleum coke circulates widely in the market, it also limits price for domestic petroleum coke. Thus, we forecast the price will be stable continuously and fluctuated slightly. In terms of fluctuation, it is no more than 13 USD/MT. From above figure, we can see clearly about the price. For low sulphur, price ranged from 297-456 USD/MT; for medium sulphur, it is lower than low sulphur, its maximum price is about 210 USD/MT; Minimum price for high sulphur is 146 USD/MT approximately.