As we enter the sixth month of 2024, the petroleum coke market remains volatile, driven by ongoing changes in supply and demand. This analysis delves into the primary factors influencing current price trends, examining economic indicators, geopolitical developments, and industry-specific events to provide a comprehensive overview of the market landscape.

Petroleum Coke Market Overview

In June 2024, petroleum coke market continued its previous trend, that is traded moderately. Concretely speaking:

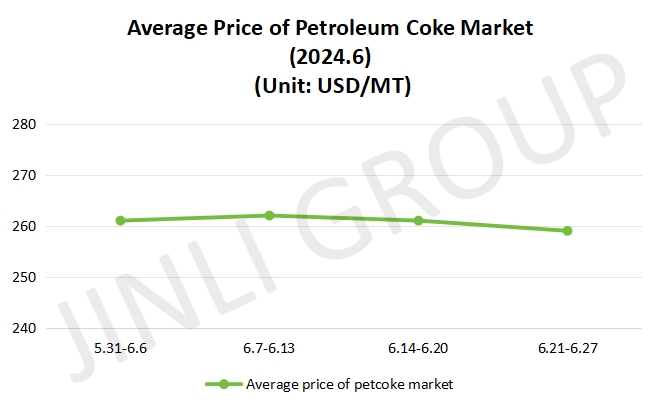

In the first half of June, as we mentioned above, the whole petroleum coke market traded moderately. For medium and high sulphur petcoke, it kept stable and fluctuated slightly. At this moment, demand for individual refineries had a decreasing trend. While, for downstream carbon industries, it continued to be sluggish and caused price for petroleum coke decline slightly.

In the second half of June, for low sulphur petroleum coke, price fluctuated narrowly. As for medium and high sulphur, there is no obvious change. Purchasing enthusiasm for downstream carbon industry is weak due to high capital pressure. Meanwhile, they purchase it according to orders, it does not provide much support for prices. Compared with the last month, average price declined to 259 USD/MT approximately.

Fig. 1 Average price

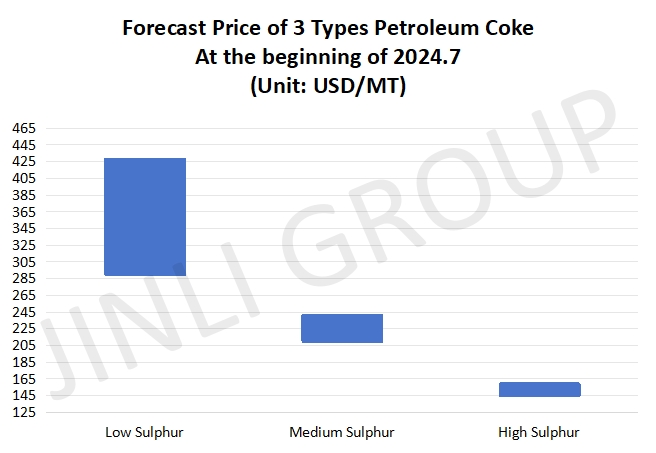

Fig. 2 Forecast price

Forecast Price for Petroleum Coke

From supply side, based on what we know, domestic petroleum coke market supply have a trend with a slight increment at the beginning of July 2024. Demand for downstream carbon industry will stay stable steadily. And plenty of traders continue procuring it according to orders.

From demand side, for downstream carbon industry, it will maintain just-needed purchases; for anode material market, due to limited orders in market, demand for petroleum coke will keep stable relatively without large fluctuation; as for graphite electrode market, its outlook is unpromising at least from now on. Its enquiry is less and less, not to mention the actual transactions. It is limited to support the price for petroleum coke in next weeks.

In conclusion, maybe supply of domestic petroleum coke will increase slightly. In addition, the prospect of downstream industry such as carbon industry, graphite electrode industry and others is still unclear and purchasing enthusiasm is weak. According to our analysis above, we anticipate the price for petroleum coke will decrease continuously at the beginning of July 2024. For low sulphur petroleum coke, its maximum price will be about 428 USD/MT; for medium sulphur, price ranged from 210 USD/MT to 241 USD/MT; regarding high sulphur, its minimum price will be 145 USD/MT approximately.