As we move into July 2024, the petroleum coke market continues to face significant price fluctuations. This analysis investigates the core factors behind these movements, focusing on supply chain challenges, demand variations, and geopolitical influences, providing a detailed overview of the current state and future outlook of the market.

Petroleum Coke Market Overview

Retrospecting the overall petroleum coke market in July 2024, it performed weakly and traded moderately.

From the supply side, it not changed a lot for domestic petroleum coke market. During this period, imported petroleum coke was still circulating in the market. In summary, it supported petroleum coke market price weakly in supply side. In the middle of July 2024, due to replenish the inventory phased for downstream enterprises and low price for a long time, price for some petroleum coke has been increased. However, downstream enterprises have meagre profits. Moreover, demand and purchasing enthusiasm for petroleum coke was weak. Therefore, price stayed stable with fluctuation. Compare with June 2024, average price for petroleum coke downed about 9 USD/MT in July 2024.

Fig. 1 Average price

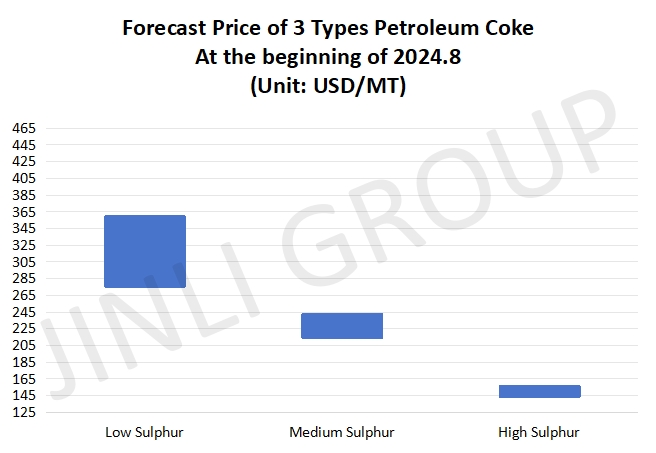

Fig. 2 Forecast price

Forecast Price for Petroleum Coke

From supply side, for domestic petroleum coke market, according to current information we obtain, we anticipate that supply of petroleum coke will be stable and it even has an increasing trend. As for imported petroleum coke, coke consumption is stable in carbon industry. Concurrently, purchasing enthusiasm for downstream enterprises is weak and most of traders purchase it depending on their orders. Therefore, inventory of port petroleum coke will be declined slightly.

From demand side, as we mentioned above, carbon industry maintain just-needed purchase. Frankly speaking, carbon industry is merely one of them. Not just it, other downstream enterprises also take the same measure, such as anode material industry, graphite electrode industry, etc.

In conclusion, downstream market situation in August 2024 is still not optimistic at least from now on. And it is limited to support the petroleum coke market price. Combination of the two, market conducive factor is insufficient. Thus, we forecast price in August 2024 will stay at low level. Price for low sulphur petroleum coke ranged from 276 to 359 USD/MT. For medium sulphur, its maximum price is about 242 USD/MT. For high sulphur, its minimum price is 144 USD/MT approximately.