By August 2024, the petroleum coke market is experiencing ongoing volatility, driven by complex factors such as fluctuating global demand, supply chain disruptions, and evolving geopolitical tensions. This analysis aims to break down these elements, offering a detailed examination of how they are impacting current price trends and what this could mean for the market in the months ahead.

Petroleum Coke Market Overview

For the first week in August 2024, petroleum coke traded moderately. Price for some medium and high sulphur petroleum coke declined. Until now, supply of petroleum coke market was still ample and demand for anode market was not optimistic. Overall, the average price for petroleum coke in this week was stable.

For the second week, the situation was similar to the first week. Downstream enterprises purchase it according to their orders, such as carbon industry and so on. Furthermore, the average price plummeted. Compared to the first week, it declined 2% approximately.

At the end of August 2024, its situation was pessimistic and petroleum coke market performed weakly continuously. It did not change a lot from previous several weeks. Most of downstream enterprises maintain just-needed purchase, hence, it supported the price weakly. It resulted in the decrease of price.

Fig. 1 Average price

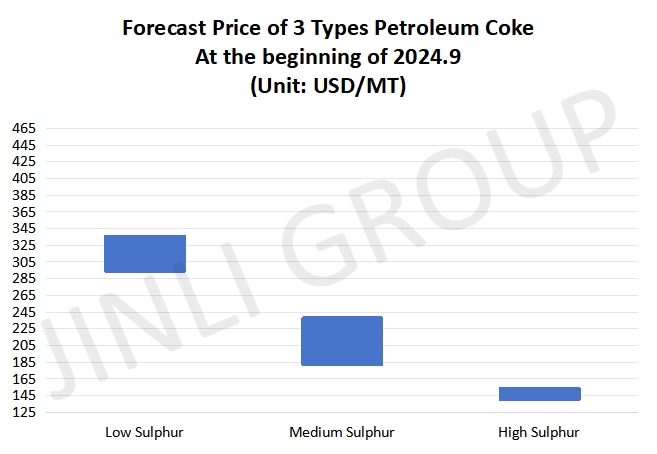

Fig. 2 Forecast price

Forecast Price for Petroleum Coke

From supply side, according to industry insiders, at the beginning of September, supply of domestic petroleum coke will have a slight increment. As for imported petroleum coke, due to weak purchasing enthusiasm, inventory in port will be increased slightly.

From demand side, outlook for downstream enterprises will be unpromising. Concretely speaking, for anode material market, it stayed at a surplus stage. Meanwhile, rate of operation has been decreased gradually; for graphite electrode market, its downstream enterprises have a weak purchasing enthusiasm, the number of orders reduced. Thus, overall, we think that it is difficult for petroleum coke market to recover in a short term.

Conclusion

In summary, overall, the average price for petroleum coke market will be stable with fluctuation. Including, price for some medium and high sulphur coke will be declined but is limited. We forecast that the fluctuation is no more than 21 USD/MT at the beginning of September 2024. For high sulphur, price ranged from 140 to 154 USD/MT; for low sulphur, maximum price is about 336 USD/MT; for medium, price is 182 USD/MT approximately or more.