The fourth quarter of 2024 brought several key developments affecting the petroleum coke market, including but not limited to changes in demand from major industries. This analysis aims to explore the factors influencing petroleum coke prices during this period, providing a comprehensive look at market trends, price drivers and the overall outlook for the industry. It is essential for navigating the complexities of the market to understand these dynamics.

Analyze Petroleum Coke Market

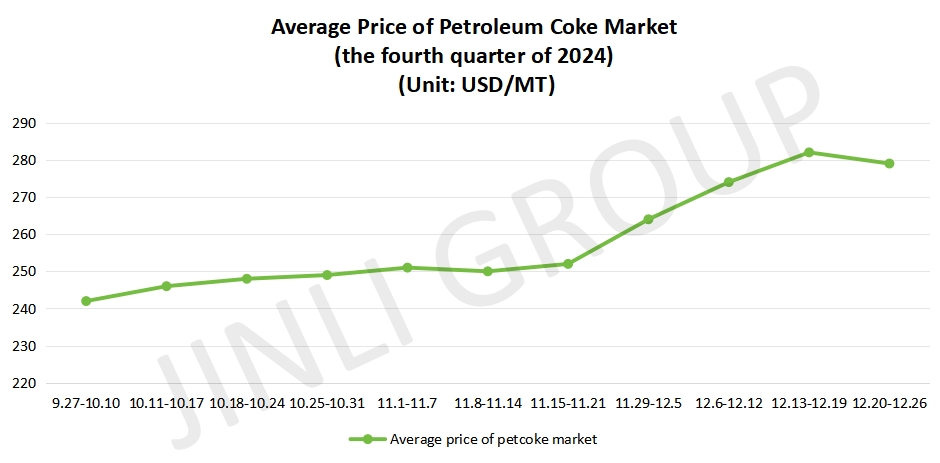

Compared with the other quarters of 2024, the fourth quarter showed a different scene, namely petroleum coke price in the fourth quarter had an upward trend.

In terms of reasons that caused this situation, it is not only one factor that resulted in this situation absolutely. On the contrary, it is the result of a combination of many factors.

Concretely speaking:

Downstream enterprises had a strong purchasing enthusiasm, instead of strong waiting mentality. Among these, anode material enterprises performed particularly well. And supply of the whole petroleum coke market was tight. Furthermore, the number of imported coke in ports fell and had a less impact on domestic petroleum coke price.

Hence, in summary, they drove petroleum coke price up significantly in December.

However, it is noted that it also had a downward trend at the end of 2024. The reason why it decreased is that downstream enterprises purchased inactively, as the petroleum coke price rose consecutively. For local refineries, it lacked the support. Thus, its price went down slightly at the end of 2024.

From figure 1, we can see the average price changes clearly. Including, in December, it increased significantly and promptly than other months. It increased by 17% approximately in Q4.

In addition, its price reached the peak at the end of the fourth quarter and its minimum price at the beginning. From the end of November, petroleum coke price started to climb gradually. At the same time, the slope was getting bigger.

Frankly speaking, the trend in the fourth quarter of 2024 is similar to the second quarter of 2024. Only, one is increased and another is decreased. Figure of fourth quarter and second quarter are symmetric about Y axis almost completely.

Fig.1 Average Price

Outlook for Petroleum Coke Market

It encounters the Chinese Spring Festival just right in January 2025. Based on our past experience, we think that many downstream enterprises are tend to replenish their inventories before the Spring Festival. It is conducive to support the petroleum coke price.

Whereas, nothing is absolute. Like carbon industry, due to limited profits and increased supply of domestic petcoke, it supports the petroleum coke price weakly and it limits the extent of price increases.

Summary

In conclusion, petroleum coke price is stable and some of petcoke still has an upward trend. For low sulfur petroleum coke, its price is higher than 344 USD/MT. As for medium and high sulfur petroleum coke, price is lower than 481 and 275 USD/MT respectively.

If you have any needs, please contact us without any hesitation!