The third quarter of 2024 saw notable shifts in the petroleum coke market, driven by changes in global production, regional demand fluctuations, and emerging economic pressures. This analysis breaks down these key factors and examines how they influenced petroleum coke prices. The report aims to provide a clear snapshot of the market trends during this period.

Analyze Petroleum Coke Market

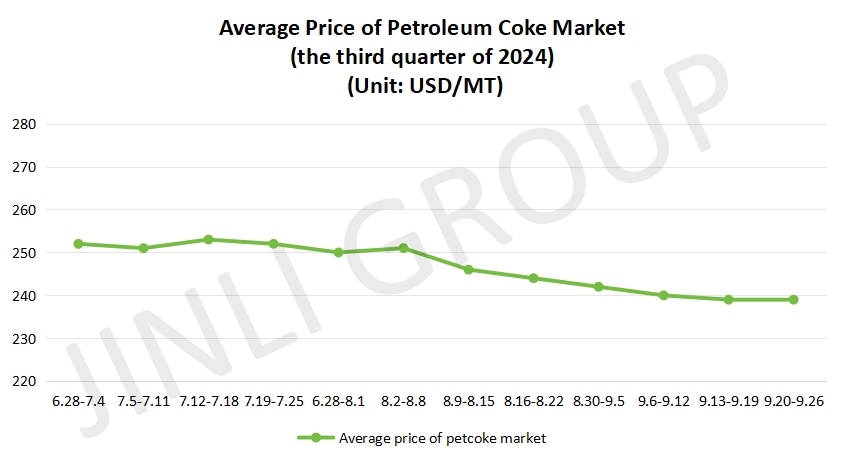

Compared with the first and second quarter of 2024, on the basis of the original, price continued falling. And it reached the low point in current stage. Overall, the situation is similar to the second quarter, that is average price of petroleum coke market dropped gradually.

As we mentioned in previous article, at that moment, most of downstream enterprises had a strong waiting mentality and purchased it depending on their orders. Eventually, it caused accumulation of petroleum coke in refinery and price downed gradually.

As for the third quarter, it differentiated prominently. For low sulphur, its price had a climbing trend. However, for medium and high sulphur, prices remained low. Besides, exchange rate between USD and CNY has fluctuated. All these factors resulted in current situation. And the whole trend of petroleum coke market was still depressing.

Fig. 1 Average Price Trend

Fig. 1 shows the average price for petroleum coke market, from this chart, we can divide it into two parts: front and back. In the front part, price does not decrease obviously, instead, it is relatively stable and fluctuated slightly. On the contrary, the back part performs worse than the front. Price for the market declined consecutively until the end of third quarter. And it reaches the bottom in the end of this quarter. Furthermore, the overall decline rate in the third quarter is 5.9% approximately. Compared with the second quarter, this data has increased by nearly 50%. In any case, this is a heavy blow to the market.

Conclusion

Concluding the petroleum coke price analysis for the third quarter of 2024, we’ve observed the combined impact of supply constraints, fluctuating demand, and external economic conditions on price movements. These insights can help industry participants anticipate future trends and make informed decisions as the market continues to respond to global energy and industrial developments.