In January 2025, the petroleum coke market starts the year with ongoing price fluctuations, driven by seasonal demand, supply issues, and global economic factors. This monthly analysis focuses on the factors impacting price trends, providing a snapshot of the current market conditions and offering insights into what may influence the market in the upcoming months.

Petroleum Coke Price Overview

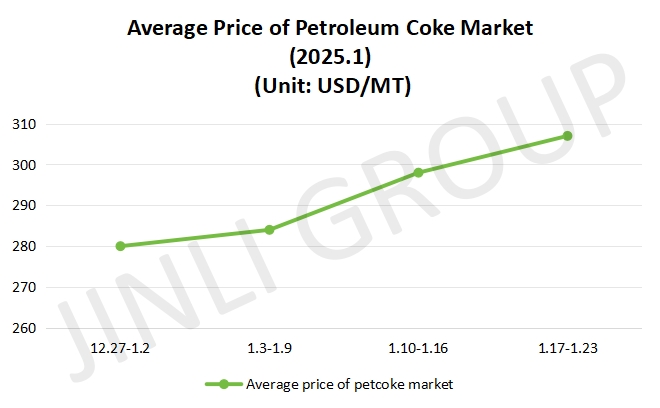

Overall, the trend for petroleum coke price still kept increasing, evenly it broke the record of the highest petroleum coke price since October 2023. It is very rare to see this situation under the economic depression condition. From the tendency chart below, we can see clearly that it increased drastically in the middle of January 2025.

Concretely speaking:

In the first half of January 2025, it is different from the end of December 2024. And it rose significantly, compared with the last week of 2024. For low sulfur petroleum coke, its supply performs weakly. Meantime, downstream enterprises were not hurried to purchase it. It caused some medium and high sulfur refineries continued to increase the price slightly. Thus, at the beginning of January 2025, petroleum coke price turned into climbing.

In the middle of January 2025, petroleum coke market traded actively and it continued increasing trend. Due to the Chinese Spring Festival holiday, downstream enterprises had a relatively strong purchasing enthusiasm to replenish their inventories. Besides, some refineries sold the products smoothly. Furthermore, they planned to maintain the equipment and reduce the production, meanwhile, supply of imported coke had a declining trend. These factors had impinged on the petroleum coke price together and supported the price. During this period, the price increased rapidly and significantly.

In the second half, compared with the previous weeks, it had no obvious changes. Under the situation that the market performed warmly, price for all kinds of petroleum cokes did not have any signs of decreasing, at least in a short term. Peculiarly, as the Spring Festival is approaching, this effect we mentioned above is amplified gradually. It caused the relationship between supply and demand changed subtly. And then, it pushed the price up. For low sulfur petroleum coke, it reached to 550 USD/MT. In this period, the petroleum coke price increased to 307 USD/MT evenly. We can see clearly this point from the tendency chart. And it reached the top price from October 2023.

Fig. 1 Average Price

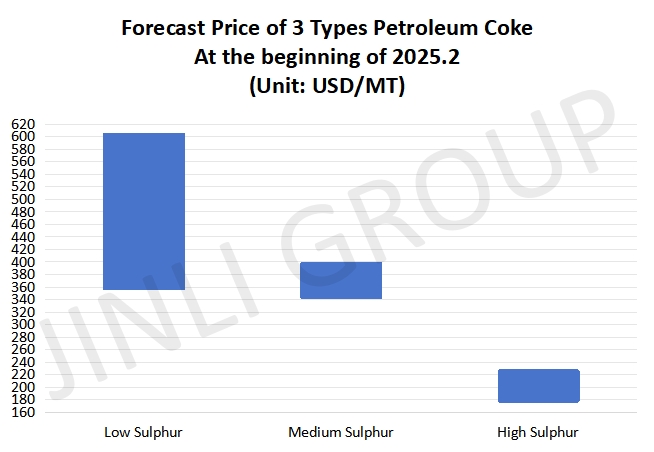

Fig. 2 Forecast Price

Petroleum Coke Price Trend

According to the information we have, some refineries will be maintained and reduce the production at the beginning of February 2025, because of meagre profit, insufficient raw material and other reasons. Based on the information, we think that it is possible for local petroleum coke supply to decline. As for imported petroleum coke, its inventories will be insufficient due to high delivery speed.

Demand for downstream enterprises will be differentiated slightly. Despite it will be differentiated, in overall, demand will stay at high level relatively. Like anode material and carbon industry, these belong to the situation we mentioned above. However, some downstream enterprises will maintain the just-needed purchase due to small order quantity. And there are many such companies. We will not list them one by one.

Conclusion

In summary, the beginning of February 2025 encountered the Spring Festival holiday just right, most of refineries will sign the order in advance. It is noted that it is not all smooth sailing. The reason why we say is that most of downstream enterprises have placed orders before the Spring Festival. Thus, the demand supports the price insufficiently. For low sulfur petroleum coke, there is a favorable trend on supply side. Based on this information, we forecast that the price for low sulfur petroleum coke still keep increasing and medium and high sulfur will be stable. We forecast the possible price range for different sulfur content is 175 USD/MT to 605 USD/MT approximately.

If you have any needs, please contact us without any hesitation!