In October 2025, petroleum coke prices remained volatile, reflecting a combination of global supply and demand imbalances, production adjustments and shifting market expectations. Key factors such as fluctuating industrial demand, geopolitical developments and ongoing logistical challenges have continued to influence price trends. This analysis explores the main drivers behind the price changes observed in October and examines the current state of the market. At the same time, it provides an outlook for the upcoming months. What’s more, it helps market participants understand potential risks and opportunities in the petroleum coke sector.

Petroleum Coke Price Overview

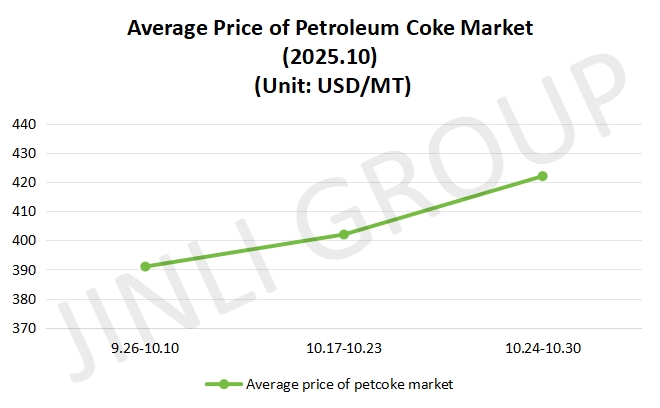

The petroleum coke market continued its upward trend after the holiday, with prices generally on the rise. Major refineries saw small increases, although some low sulfur coke prices adjusted downward. Overall, market demand remains supportive, with downstream carbon material manufacturers continuing their stockpiling activities after the holiday. The order volume for anode materials has not decreased, maintaining stable procurement levels. Local refineries performed well, with some adjustment in the pace of shipments or fluctuations in specifications, but the overall trend for petroleum coke prices remained on the rise. The market showed stable performance for sponge coke, which followed the trend of domestic coke prices with slight increases. At the end of this week, the average price of petroleum coke reached 390 USD/MT, marking a consistent growth in the market.

In the middle of October 2025, it saw a strong upward momentum in the petroleum coke market, with prices primarily on the rise. Anode material orders increased and some refineries announced maintenance schedules, which tightened supply expectations. Low sulfur petroleum coke prices were pushed higher and medium and high sulfur petroleum coke prices followed suit. The local refinery market showed improvement, with steady demand supporting prices. Many medium and low sulfur petroleum coke products followed the price increase trend of major refineries, although some high sulfur petroleum coke prices adjusted downward as the supply and demand balance fluctuated. Some traders were cautious, anticipating further price increases. By October 23rd, 2025, the average petroleum coke price reached about 402 USD/MT.

The petroleum coke market maintained a positive trading atmosphere, with prices continuing their upward trajectory. Major refineries saw smooth shipments of medium and low sulfur coke, as downstream demand from anode material and carbon material manufacturers remained strong. Additionally, refineries in some regions reduced their production loads, further tightening supply expectations and supporting price increases. High sulfur coke followed the overall market trend, increasing in price. Local refineries also faced no pressure in shipments, with many experiencing low stock levels and petroleum coke prices saw a dominant upward movement. Some traders, sensing higher future prices, withheld stocks, only releasing limited amounts for spot sales.

Fig. 1 Average Price

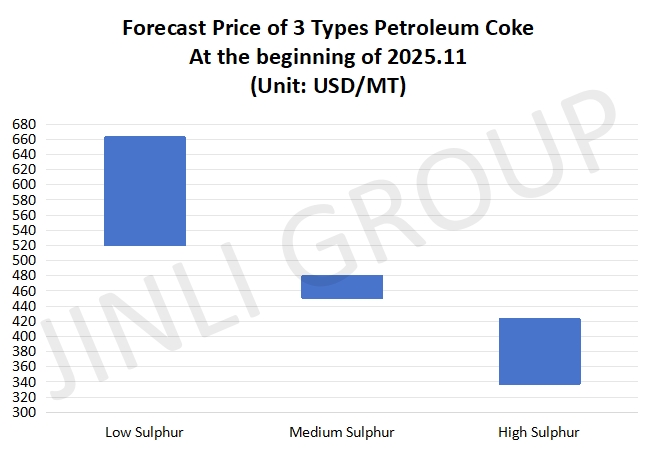

Fig. 2 Forecast Price

Petroleum Coke Price Trend

At the beginning of November 2025, one coking unit is expected to undergo maintenance, it resulted in reduction of low sulfur petroleum coke production. However, other coking units will resume production. To a certain extent, this trend has been curbed. As a result, the domestic petroleum coke supply is expected to see a slight decrease. On the import side, port inventory continues to deplete, with an increase in the speed of shipments. The expectation is that port stocks will continue to decline in the coming week as shipments accelerate.

Downstream industries, including carbon materials for aluminum production and anode materials, are operating at a good pace, maintaining strong demand for petroleum coke. In the short term, the silicon carbide market is relatively stable with no major changes expected, so demand for petroleum coke will remain steady. The graphite electrode sector is operating at a stable production pace, although with the heating season approaching, some companies may consider production cuts, which could impact their petroleum coke procurement on a needs-based basis.

Conclusion

Given the continued reduction in supply expectations for the beginning of November 2025, the supply-side outlook remains favorable for the petroleum coke market. Downstream demand from anode and carbon material plants is expected to remain strong. It continues to support the market. Therefore, it is anticipated that the prices for medium and low sulfur petroleum coke from major refineries will have a slight upward trend. High sulfur petroleum coke is also expected to follow with a slight increase. The market for local refineries will likely see some small price increases, although there may be slight downward adjustments for those at higher price points. The primary price range for petroleum coke is as follows: low sulfur petroleum coke will transact at 520-662 USD/MT. For medium sulfur, the maximum price will be about 479 USD/MT. And for high sulfur, its minimum price will be 338 USD/MT approximately.

If you have any needs, please contact us without any hesitation!