In November 2025, petroleum coke prices experienced further fluctuations and influenced by a range of factors including shifts in demand from key industries, supply chain disruptions and global economic conditions. As production levels and trade flows adjusted to market pressures, pricing trends continued to evolve. This analysis provides an overview of the key factors impacting the petroleum coke market this month, offering insights into the current price movements. Additionally, it looks ahead to potential developments that could shape pricing in the near term. It helps industry stakeholders plan for the coming months.

Petroleum Coke Price Overview

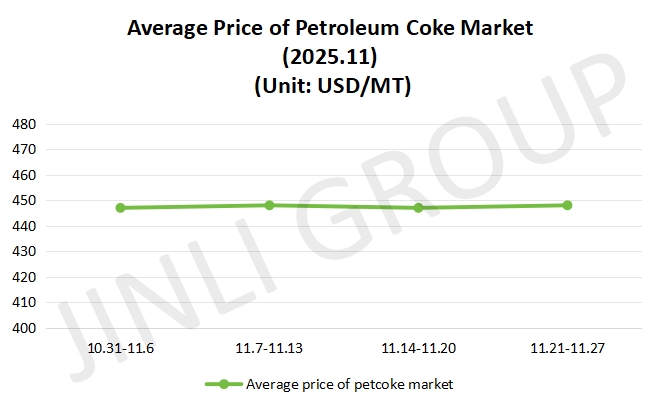

Between October 31 and November 6, the petroleum coke market saw strong activity with prices dominated by an upward trend. Refineries experienced a general increase in prices, especially for low sulfur petroleum coke, driven by steady demand from the downstream sectors, such as energy storage and power. Production cuts in key regions like the northwest and northeast further supported price growth, particularly for low sulfur petroleum coke. Meanwhile, high sulfur petroleum coke saw steady shipments, contributing to the overall price increases. The import sector also remained active, with fast port shipments depleting spot resources. The average petroleum coke price rose and reached about 447 USD/MT. However, the market saw a slight slow-down in the second week of November 2025, with prices stabilizing and showing more differentiation. Low sulfur coke remained stable in refineries, while high sulfur coke prices fluctuated. The import market showed slower activity with fewer new transactions for sponge coke, though low sulfur grades remained firm.

In the second half of November 2025, the petroleum coke market displayed mixed trends, with prices rising in some areas and falling in others. Major refineries saw price stability for low sulfur coke, while medium and high sulfur coke prices adjusted based on market demand. Downstream demand remained stable, but the overall market faced price fluctuations due to regional production and export shifts. Local refineries experienced slower shipments as high prices dampened downstream purchasing, leading to price reductions in some regions. However, these price cuts were followed by slight recoveries in sales. On the import side, port shipments remained stable, but sponge coke prices saw small declines. Low sulfur petroleum coke prices held steady in refineries, while medium and high sulfur petroleum coke showed price adjustments based on regional market conditions. From Fig. 1, we can see clearly that the average petroleum coke price fluctuated slightly near 447 USD/MT in November 2025.

Fig. 1 Average Price

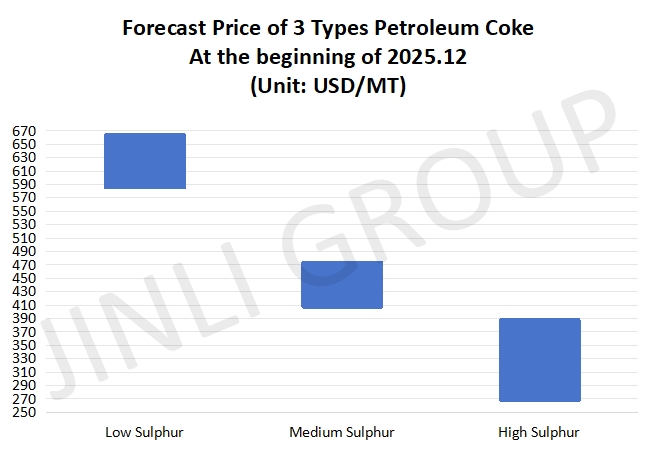

Fig. 2 Forecast Price

Petroleum Coke Price Trend

Looking ahead to the coming week, there are plans to restart two coking units that have been undergoing maintenance. These restarts are expected to increase daily production by around 1400 tons, which could lead to a slight increase in the domestic petroleum coke supply at the beginning of December 2025. As for imports, port shipments are expected to slow down, as the execution of prior orders is nearing completion. Consequently, the overall stock of imported petroleum coke is likely to remain stable with only minor fluctuations in the near term. This implies a relatively steady supply of petroleum coke across both domestic and imported markets for the upcoming week.

On the demand front, the market for petroleum coke remains relatively stable. Downstream industries, such as the aluminum carbon sector are expected to maintain steady purchasing activity, with a consistent demand for petroleum coke. The anode material market continues to show positive signs, with growing orders from enterprises, which will likely result in a stable demand for petroleum coke as a key raw material. However, the graphite electrode sector, which is a significant consumer of petroleum coke, is seeing little change in production pace, suggesting that the overall demand for petroleum coke in this area will remain relatively unchanged. Additionally, the silicon carbide market is experiencing limited volatility and while production pressures persist for some enterprises, their demand for petroleum coke remains constrained.

Conclusion

Overall, the domestic petroleum coke market is expected to see a slight increase in supply at the beginning of December 2025, due to the restart of equipment, while downstream demand remains steady across key sectors. The market will likely maintain its support from essential replenishment needs, with only modest fluctuations in pricing. Based on these factors, we predict that petroleum coke prices will remain stable for the most part at the beginning of December. However, there could be a slight downward adjustment in prices for local refinery products. The main price range for petroleum coke is as follows: low sulfur petroleum coke is expected to trade at 585-664 USD/MT; for medium sulfur petroleum coke, its maximum price is about 474 USD/MT; as for high sulfur petroleum coke, its minimum price is 268 USD/MT approximately.

If you have any needs, please contact us without any hesitation!