As December 2025 progresses, petroleum coke prices continue to reflect market adjustments driven by supply and demand factors, economic shifts and production changes. This analysis outlines the key influences on pricing during the month, offering a snapshot of the current market situation and providing insights into the potential direction of prices as the year closes.

Petroleum Coke Price Overview

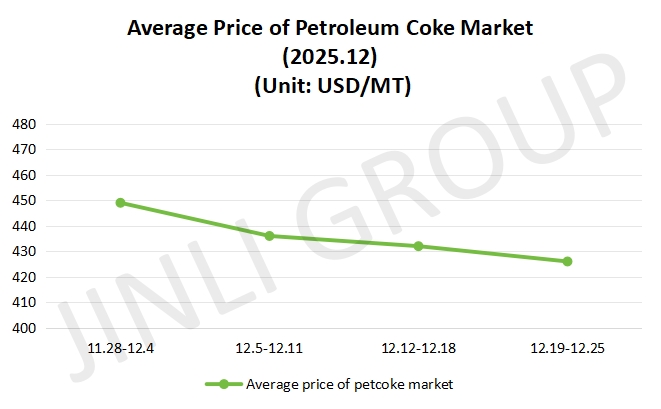

Between November 28 and December 4, the petroleum coke market exhibited a mixed trend, with price fluctuations across different grades. The pace of low sulfur petroleum coke sales from major refineries slowed down slightly, but some prices remained firm due to consistent downstream demand. However, certain refineries continued to experience inventory pressure, leading to declines in bidding prices. Medium and high sulfur coke followed a similar pattern, while high sulfur petroleum coke experienced slight price decreases. Local refineries saw an improvement in their shipments compared to previous weeks, as early-month demand from downstream buyers showed signs of recovery. However, limited purchasing capacity from downstream sectors kept price hikes in check. In the import market, sponge coke shipments showed slower movement, with downstream buyers remaining cautious. Traders negotiated on prices and a few deals saw slight reductions in prices. The average price reached about 449 USD/MT, indicating only a small decrease from the previous week. This reflects the ongoing volatility in the market, where demand and supply factors were still in a state of adjustment.

In the second week of December 2025, the petroleum coke market experienced further weakness, with prices coming under downward pressure. Low sulfur petroleum coke prices showed mixed movements, with prices declining in the Northeast region as downstream demand softened. The general market sentiment turned bearish, as downstream buyers hesitated to make purchases at higher prices, thus limiting market support. Some refineries were able to secure small price increases, but these were mostly offset by price declines elsewhere, particularly for lower grade products. Medium and high sulfur petroleum coke saw limited movement, with high sulfur petroleum coke prices continuing to decrease as demand from key industries remained sluggish. This lack of demand led to price drops for refinery products, particularly for medium and high sulfur coke. What’s more, the pace of shipments slowed, with port inventories moving at a slower rate and fewer new contracts being signed. High sulfur petroleum coke prices experienced a decrease, reflecting the general softness in the market.

In the third week, the petroleum coke market showed mixed trading conditions, with some prices increasing and others continuing to decline. Demand for low sulfur remained steady, with prices seeing moderate adjustments as refineries adapted to earlier market trends. While low sulfur coke sales stabilized, some local refineries saw price improvements after prices dropped to more competitive levels, prompting renewed downstream interest. Medium and high sulfur coke experienced more volatility. Overall market conditions for medium and high sulfur coke remained sluggish, with limited transactions taking place in key markets. Local refineries exhibited mixed results: some continued to struggle with high price coke, while others found relief as they reduced prices to attract buyers. On the import side, port inventories remained slow to move and new transactions for imported coke were limited.

In the last week, the petroleum coke market showed further signs of divergence, with prices continuing to fluctuate. Major refineries faced weak trading conditions, with low sulfur coke prices generally trending downward, reflecting the cautious attitude of downstream buyers. The slower pace of purchases and the hesitance to accept higher prices created a bearish environment for many refineries. Medium and high sulfur coke saw increasing resistance in terms of sales, with some refineries continuing to reduce prices to move inventory. However, local refineries showed some resilience as prices dropped to lower levels, prompting downstream buyers to take advantage of the situation and enter the market, leading to slight price increases in some regions. In contrast, the import market remained slow, with inventory levels still high and fewer new contracts being signed. Overall, the market continued to exhibit soft demand, with limited upward price movement. The market price reached 426 USD/MT, reflecting a further decline in petroleum coke prices as market conditions remained weak.

Fig. 1 Average Price

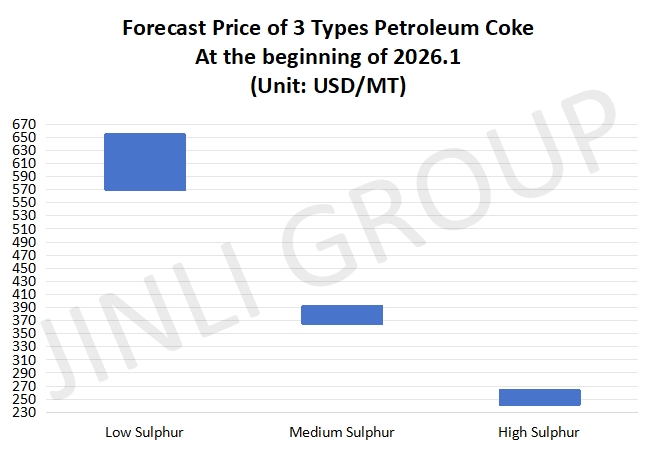

Fig. 2 Forecast Price

Petroleum Coke Price Trend

Looking ahead to the beginning of January 2026, one equipment that had previously undergone maintenance is expected to resume operations. It could lead to a modest rise in daily domestic petroleum coke availability. On the import side, although there has been an increase in imported petroleum coke shipments, the number of new contracts remains relatively low. Port inventory levels are still experiencing slow digestion and the general pace of imports continues to be sluggish. As a result, this gradual buildup of inventory combined with the increase in domestic production. It suggests that the overall supply of petroleum coke will remain stable, though with some modest growth.

Demand for petroleum coke from downstream industries remains relatively stable. The carbon industry and anode material market continue to show reasonable purchasing activity. It provides support for petroleum coke prices. The graphite electrode market is stable and most companies focused on executing existing orders. As a result, the overall demand for petroleum coke remains steady but without major growth, as these key industries continue with consistent procurement practices. While some downstream demand provides a foundation for price stability, it does not significantly drive prices higher.

Conclusion

The petroleum coke market is expected to maintain a steady course at the beginning of January 2026. Major refineries producing low sulfur petroleum coke are expected to see their prices remain firm. Local refineries may experience modest price increases, though some price reductions may also occur. The main price range for petroleum coke is as follows: low sulfur petroleum coke is expected to trade at 570-654 USD/MT; for medium sulfur petroleum coke, its maximum price is about 392 USD/MT; as for high sulfur petroleum coke, its minimum price is 242 USD/MT approximately.

If you have any needs, please contact us without any hesitation!