As February 2025 unfolds, the petroleum coke market remains in a state of flux, with prices impacted by supply-demand imbalances, economic pressures, and market adjustments. This report explores the latest pricing patterns, identifies the main drivers behind recent shifts, and offers a glimpse into how these factors might influence the market in the short term.

Petroleum Coke Price Overview

The first week of February 2025 encounters the Chinese Spring Festival, as usual, we do not analyze the petroleum coke price during the holiday.

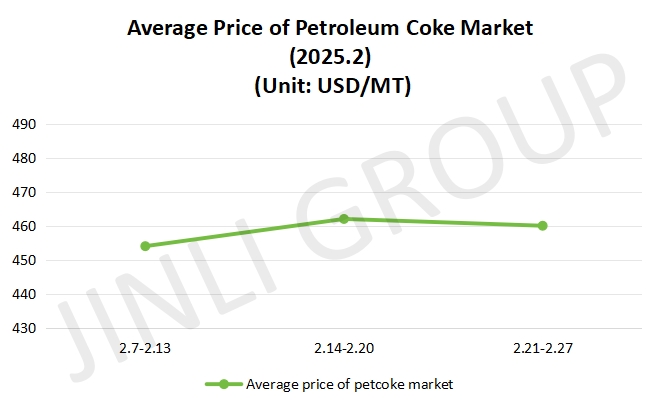

In general, petroleum coke price kept stable and increased significantly at the beginning of February. Notwithstanding it performed highly, good times do not last long, at the end of February 2025, its increasing speed slowed down, compared with the beginning, even the price fell.

Concretely speaking:

For the second week, price for petroleum coke still showed an upward trend and it traded warmly. The inventory was not enough in this week, therefore, it resulted in the tight supply. It supported the price from the source. At the same time, this week is the first working week in China, most of downstream enterprises started to procure the material. Besides, exchange rate between USD and CNY also impinged on the price. Based on the information, these factors had an impact on the price together more or less. And they made the price rise significantly. Compared with the last week, average price for petroleum coke had increased by 32.8% approximately. And it broke through the 450 USD/MT mark.

For the third week, it was another scene. As we mentioned above, many factors supported the price. However, some factors were different from the last week, whether supply or demand side. For supply side, it did not change a lot and refineries kept supplying tightly. While, for demand side, due to the bulk purchase in the last week, they had a relative strong waiting mentality. It affected the supply in refineries, they had to reduce the price, in order to release the pressure. Affecting by these, the average price increase was slight, compared with the last week. It is noted that the average price kept rising.

For the fourth week, petroleum coke market has changed significantly. For main refineries, price for low sulfur petroleum coke showed a downward trend. In the meantime, downstream enterprises’ attitudes for market had an imperceptible change, it is more prudent of downstream enterprises to procure the raw material. Then, it caused the accumulation of refinery inventory. Hence, it formed a chain reaction. Eventually, its result was price dropping, notwithstanding it was not drastically. It was the first turning point since the end of 2024.

Fig. 1 Average Price

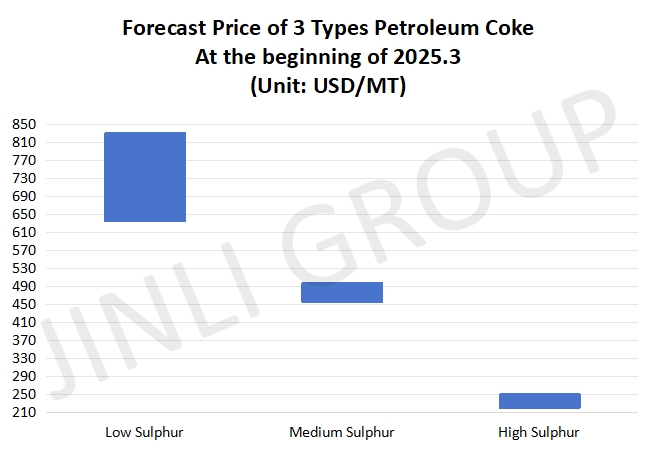

Fig. 2 Forecast Price

Petroleum Coke Price Trend

Based on the information and insiders’ words, at the beginning of March 2025, refinery have an active mentality for the production. In theory, it is not a good news for the price support. Furthermore, most of traders purchase it according to their orders, thus, the number of imported coke in ports will be declined slightly.

Generally speaking, different downstream enterprises have different demands for petroleum coke. For most of carbon industry enterprises, they face greater costs pressure, causing inactively procure. The same thing happened to some calcined petroleum coke enterprises. Anode material is also used in new energy vehicle industry. When it comes to new energy vehicle industry, it is an emerging industry in recent years. As the new energy vehicle market traded actively, it has led to the gradual recovery of anode material industry. The number of inquiries shows an upward trend, while, there is no significant increase in the number of orders.

Conclusion

In conclusion, based on the information we mentioned above, for medium and high sulfur petroleum coke, price will be stable. Not only low sulfur petroleum coke price but also high price petroleum coke, there is still a risk of falling at the beginning of March 2025. We forecast the low sulfur petroleum coke price is about 640 USD/MT, for medium sulfur, it is 460 USD/MT approximately.

If you have any needs, please contact us without any hesitation!