The petroleum coke market in March 2025 has experienced notable fluctuations, driven by both supply and demand dynamics. Over the first few weeks, prices have shown a downward trend due to weak demand and excess supply. However, as the month progressed, certain factors, including refinery maintenance and increased downstream purchasing activity, began to influence price movements. This article provides a detailed analysis of the market’s performance, examining the key drivers of price changes, supply-side developments, and demand trends in various industries. Additionally, we will look ahead to potential shifts in the market for the beginning of April 2025.

Petroleum Coke Price Overview

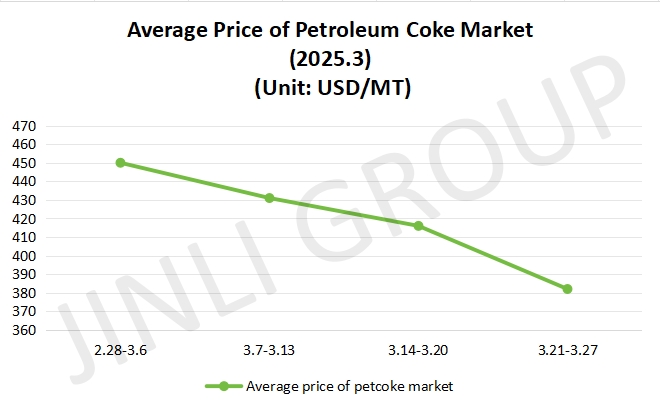

The petroleum coke market in the first two weeks of March exhibited both common trends and differences. Both weeks were marked by price declines, with weak demand and excess supply driving the market down. In the first week (2.28-3.6), sluggish trading and cautious buyer behavior led to a moderate price decrease, while the second week (3.7-3.13) saw even steeper price drops as inventory levels rose and buyers remained hesitant. However, the second week also highlighted an increasing inventory buildup at refineries, which put additional downward pressure on prices. Despite these similarities, the second week showed a slightly more pronounced decline, reflecting a deeper sense of market caution and slower demand. While both periods struggled with low confidence, the first week displayed more limited buyer activity, while the second week saw some inventory accumulation as a reaction to anticipated supply tightening. This difference suggests that while market conditions were largely negative, expectations about future supply disruptions began to influence buyer behavior toward the end of the second week.

The petroleum coke market in the third and fourth weeks of March presented contrasting dynamics compared to the earlier part of the month. From March 14 to 20, the market saw slight improvement in trading activity. Buyers became more active, with local refinery prices rebounding as downstream buyers seized the opportunity to purchase at lower prices. From March 21 to 27, the market became more volatile, with prices fluctuating in both directions. Auction sales for low sulfur coke at ports gained momentum, and some price increases were seen, particularly for low sulfur coke from major refineries. Sinopec’s maintenance further supported price increases for high sulfur coke, but local refineries faced slower sales, causing their prices to continue to drop before rebounding slightly. By March 27, the average price fell to 382 USD/MT.

Fig. 1 Average Price

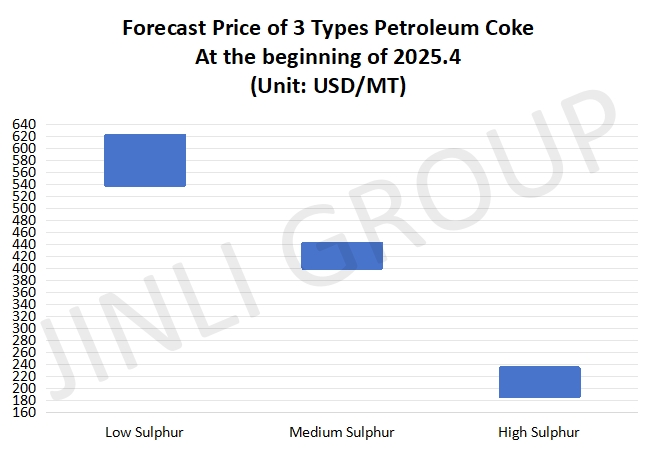

Fig. 2 Forecast Price

Petroleum Coke Price Trend

Looking ahead to next week, the supply of petroleum coke is expected to remain relatively stable, with only minor fluctuations in domestic production. One coking unit is anticipated to begin operations, while another is set to shut down, leading to a net neutral impact on overall supply. Import levels remain subdued, with sluggish discharge rates at the ports, meaning that the flow of imported petroleum coke continues to be slow. This may lead to an increase in inventory levels at the ports next week, though the overall supply is not expected to experience any significant shifts. Supply-side pressures are expected to remain stable, with the market awaiting further signals regarding domestic production and potential supply chain developments.

On the demand side, the market continues to be driven primarily by essential purchases, especially from industries such as aluminum carbon products. These industries are maintaining steady operations, ensuring that the demand for petroleum coke remains stable, albeit at a moderate level. The anode material market, which had been sluggish, is seeing a gradual recovery, but the overall increase in orders and inquiries has been slower than anticipated. Larger manufacturers are keeping their operations stable, thus, their demand for petroleum coke remains consistent. However, smaller and mid-sized companies still face difficulties and are operating at reduced capacity, limiting their contribution to overall demand. Additionally, the silicon carbide industry, especially in the southern regions, continues to show a steady need for high sulfur petroleum coke, which is helping maintain demand for this segment. The graphite electrode market, on the other hand, remains stable but continues to operate at low levels, contributing only marginally to the overall demand for petroleum coke.

Conclusion

With the beginning of the month, downstream industries are likely to increase their stockpiling activities, especially in response to the general expectation of rising prices. Despite this, many companies still hold adequate stock of raw materials, so the purchasing activity will largely remain driven by immediate needs. As a result, prices for low sulfur petroleum coke from major refineries are expected to rise moderately, while middle and high sulfur coke will continue to be sold based on demand. Local refineries are likely to maintain stable pricing, though some minor fluctuations may still occur depending on regional market conditions. Overall, the price ranges for petroleum coke are expected to be as follows: low sulfur coke will likely trade between 535-620 USD/MT, medium sulfur coke will fall between 400-440 USD/MT and high sulfur coke will range from 185-235 USD/MT. These price trends suggest a stable to slightly upward movement, reflecting ongoing supply-demand dynamics and market sentiment.

If you have any needs, please contact us without any hesitation!