The petroleum coke market in April 2025 has experienced significant fluctuations, influenced by supply constraints, tariff adjustments and varying demand from key downstream sectors. Throughout the month, price trends have been shaped by ongoing refinery maintenance, shifts in U.S. tariff policies and the steady demand for petroleum coke from industries such as aluminum production and anode materials. However, market conditions remain somewhat volatile, with pricing movements reflecting both external factors and cautious purchasing behavior across various sectors. This article offers a detailed analysis of the market’s performance, highlighting key developments and providing an outlook for the coming weeks.

Petroleum Coke Price Overview

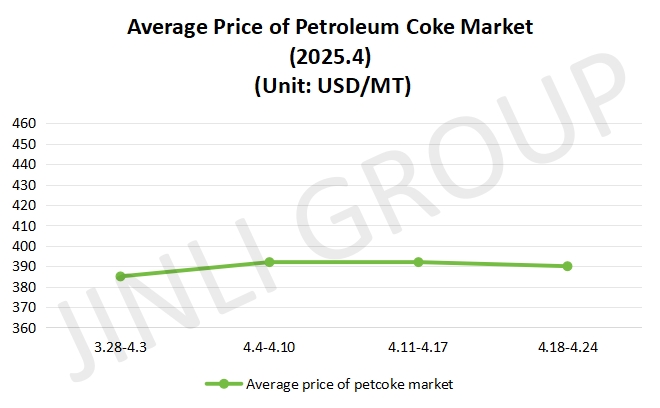

At the beginning of April 2025, the petroleum coke market experienced moderate trading activity, with prices primarily trending upward. Major refineries undergoing maintenance led to a reduction in supply, offering some price support. While local refineries showed mixed performance, some increased prices due to tight supply and ongoing maintenance, while others adjusted prices downward due to slow sales. Furthermore, in this week, Trump government carried out the reciprocal tariff policy. They imposed tariff on almost all countries, whether it is cooperation partner or not, even on penguin. It is very ridiculous! Due to this, it affected the exchange rate directly. Thereby, it impinged on petroleum coke price. The U.S. tariff was adjusted twice during the week, which is expected to reduce U.S. imports. This led to a rise in prices for some imported high sulfur petroleum coke. For the beginning, the average petroleum coke price reached 392 USD/MT. Overall, the market saw upward price movement, driven by supply restrictions and tariff adjustments influencing the price structure.

In the middle of April 2025, the petroleum coke market showed divergent price trends across different sectors. Major refineries saw mixed price movements, with some raising prices slightly, while others lowered prices due to weaker downstream demand. Low sulfur coke prices, in particular, saw modest declines, while maintenance activities continued to support higher prices in some sectors. The downstream purchasing pace slowed, with some local refineries facing weak sales, pushing their prices downward. At the same time, U.S. tariff changes continued to affect the market, contributing to slight price increases for imported petroleum coke. This period highlighted the market’s volatility, as the impact of maintenance and tariffs resulted in varied pricing patterns across different types of coke.

At the end of April 2025, the petroleum coke market weakened, with some price adjustments showing a downward trend. Major refineries experienced stable prices, with some minor decreases in certain sectors. Low sulfur coke saw slower sales, with demand mainly focused on essential purchases, leading to a more restrained price movement. The pressure from increased inventory levels at refineries also contributed to the softer market conditions. Meanwhile, the maintenance season continued to exert some support for supply, but this was counterbalanced by weaker downstream demand. High sulfur and medium sulfur coke prices remained largely stable, though some fluctuations were noted. Local refineries, struggling with weak sales, had to adjust prices downward. Port deliveries also slowed, leading to a buildup of inventory. The average petroleum coke price stood at 390 USD/MT. The end of April 2025, it reflected the ongoing balance between maintenance-driven price support and a slowing demand, particularly in key sectors.

Fig. 1 Average Price

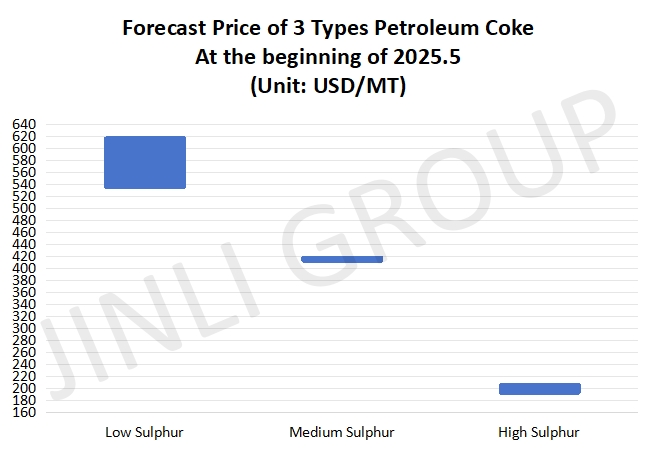

Fig. 2 Forecast Price

Petroelum Coke Price Trend

At the beginning of May 2025, the petroleum coke supply is expected to see slight reductions. A coking unit is scheduled for shutdown, which will reduce daily production. However, another coking unit plans to resume production. Taken together, these changes suggest a slight decrease in domestic petroleum coke supply. On the import side, vessels are arriving at ports, but the market is absorbing these shipments slowly. As a result, there is a likelihood of continued inventory build-up at the ports in the coming weeks. Overall, the domestic supply side is relatively stable, with a slight decrease in output expected due to the planned shutdown, while imported material faces slow market digestion.

On the demand side, downstream industries are maintaining stable procurement of petroleum coke. The carbon industry continues its consistent purchasing pace, while the anode material market sees minimal fluctuations in inquiries and orders. Most companies are operating on a “sales-based production” model, meaning their demand for raw materials, including petroleum coke, remains steady. In the fuel and silicon carbide markets, conditions remain weak, notwithstanding, there is still some demand for high sulfur petroleum coke. The graphite electrode market, however, remains sluggish, with no significant increase in demand for petroleum coke as production levels stay low. Overall, while demand remains relatively stable, there is little upward momentum in purchasing activity, especially from industries like graphite electrodes and silicon carbide.

Conclusion

Looking ahead to May 2025, downstream companies are expected to be more cautious with their petroleum coke purchases due to the approaching Labor Day holiday, which traditionally brings increased financial pressure on businesses. Some refineries may accelerate stock clearance ahead of the holiday, adding some volatility to the market. As a result, the petroleum coke market is expected to see mostly stable prices, with only minor fluctuations. Low sulfur petroleum coke price is likely to remain in the range of 535 USD/MT to 617 USD/MT, while medium sulfur petroleum coke will likely trade approximately 415 USD/MT. As for high sulfur petroleum coke, its maximum price will be about 206 USD/MT. While the market remains generally weak, price movements will largely be determined by seasonal factors and the balance of supply and demand as refineries manage stock levels and adjust to market conditions.

If you have any needs, please contact us without any hesitation!