In May 2025, petroleum coke price remained under pressure as modest domestic supply shifts and steady imports outpaced cautious, essential, only purchasing by downstream industries. Despite isolated refinery maintenance support, ample inventories and subdued demand kept price movements muted across low, medium and high sulfur grades, defining a weak and stable market.

Petroleum Coke Price Overview

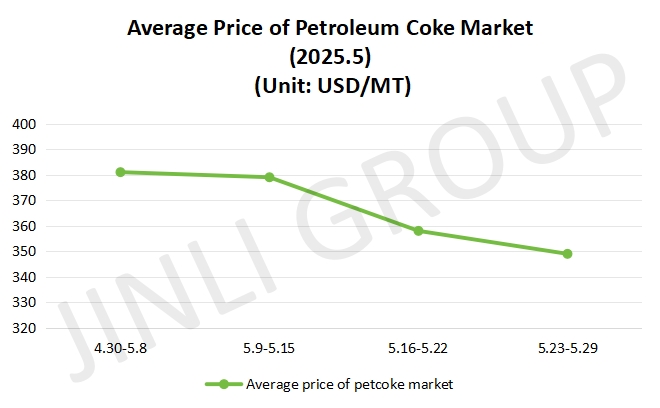

Between April 30 and May 15, the petroleum coke price trend was characterized by a broadly weak market environment, driven by insufficient downstream demand and persistent inventory pressures. In the first period, trading was subdued as buyers adopted a “buy on upticks” mentality, avoiding purchases amid falling prices, leading to increasing low sulfur coke stockpiles. High and medium sulfur grades, despite being in the maintenance season at major refineries, failed to garner significant interest because downstream users remained cautious. Imports flooded into ports, augmenting inventories and further weighing on prices, which slid to 381 USD/MT. In the following week, volatility emerged: while the dominant trend remained a decline, average prices dipping to 379 USD/MT. Some local refineries saw improved off-takes, prompting isolated, minor price hikes. This divergence reflected how plentiful import resources and rising domestic stocks continued to undercut low sulfur coke, whereas select downstream buyers, anticipating tighter supplies due to planned shutdowns, selectively replenished mid and high sulfur grades. Overall, both weeks shared a weak demand backdrop and rising port inventories, but the second week displayed a slightly more nuanced market, with localized upward support for certain grades despite the overarching downward pressure on petroleum coke price.

From May 16 to May 29, petroleum coke price movements continued to reflect tepid demand and ample supply, especially from imports, although the depth of price declines varied. Between May 16 and 22, market activity was notably soft: major refineries pushed low sulfur coke prices lower as both supply and demand fundamentals weakened, resulting in average prices plunging to 358 USD/MT. Concurrent refinery restarts and shutdowns neutralized supply changes, but downstream customers burdened by high inventories, restricted purchases to essential volumes. Imports persisted at high levels, filling port stocks and prolonging the downward trend. In the subsequent week, while the overarching trend remained negative, average prices eased to 349 USD/MT. The market showed marginal stabilization. Major refineries continued modest price cuts on low sulfur coke due to weak off-takes, yet local producers exhibited minor up-and-down adjustments as demand from the aluminum and anode material sectors steadied marginally. Despite this, port inventories grew further and high sulfur grades remained under downward pressure from their low sulfur counterparts. In sum, both periods were marked by sluggish trading and declining prices, but the final week of May hinted at a slight tempering of losses in certain segments of the petroleum coke price spectrum.

Fig. 1 Average Price

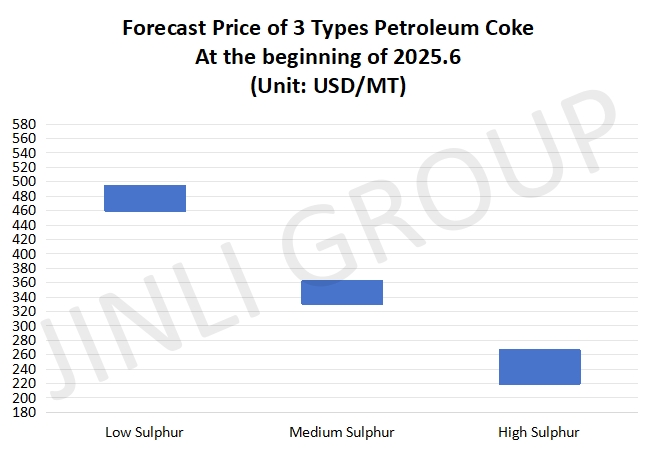

Fig. 2 Forecast Price

Petroleum Coke Price Trend

Supply outlook suggests a slight uptick in petroleum coke production. One coking unit is slated for shutdown, due to maintenance. While another is set to resume production. Additionally, a few smaller producers might increase output marginally due to favorable quota adjustments. However, imported volumes continue to arrive amid sluggish downstream absorption, causing port stockpiles to swell. With downstream buyers remaining cautious, this accumulation is expected to persist. Overall, while domestic supply could inch higher, abundant imports and limited offtake will keep upward pressure on petroleum coke price muted.

Downstream demand remains relatively tepid, exerting limited support on petroleum coke price. Carbon producers will maintain current buying levels without significant increases, focusing on inventory turnover rather than restocking. Anode material manufacturers show minimal fluctuation in inquiries and orders, operating on a sales, driven procurement model that keeps purchases steady. The silicon carbide and southern fuel markets continue to draw on high sulfur coke for blending, but demand remains in line with existing contracts. Graphite electrode makers operate at low to break, even capacity, translating into only foundational purchasing. Consequently, overall demand will likely remain stable but subdued, constraining price momentum.

Conclusion

In summary, petroleum coke price is expected to hover in a weak-stable range at the beginning of June 2025. Supply adjustments are driven by equipment shutdown and restart, it may slightly boost domestic output, but this will be offset by persistent import driven port inventories. Downstream restocking is limited, as most industries adhere to cautious procurement strategies. Low sulfur petroleum coke could see small price upticks, reflecting marginal demand support, while medium and high sulfur grades will trade within constrained brackets. Anticipated prices are: maximum price for low sulfur is about 494 USD/MT, minimum price for medium sulfur is 331 USD/MT approximately and price range for high sulfur is 220 – 266 USD/MT.

If you have any needs, please contact us without any hesitation!