In June 2025, petroleum coke price showed mixed movements as market participants responded to changes in production levels, import volumes and downstream demand. This report outlines the main factors that affected pricing during the month, including supply availability and buying activity. What’s more, it provides a straightforward look at how the market is adjusting to current conditions.

Petroleum Coke Price Overview

Low sulfur petroleum coke price remained steady. As for medium and high sulfur petroleum coke, it saw minor fluctuations.

Concretely speaking:

Between May 30 and June 12, the petroleum coke market displayed mixed trading dynamics, it reflects shifting demand and price responses.

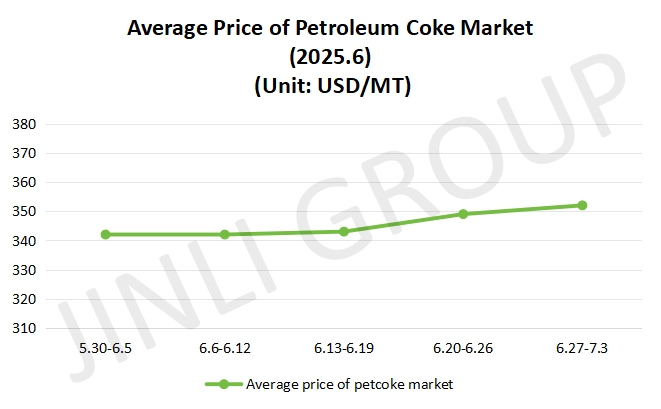

From May 30 to June 5, the market showed varied performance, with some major refineries seeing price increases for low sulfur petroleum coke. This was attributed to ongoing adjustments in prices and scheduled maintenance plans, which contributed to reduced market uncertainty. As a result, downstream enterprises became more active. Meanwhile, medium and high sulfur petroleum coke continued to face downward price pressure. For imported coke, due to slow offloading, it contributes to higher inventories at ports.

For the second period of June 2025, the market exhibited slight improvements, particularly in the demand for low sulfur petroleum coke. Despite continued price declines, purchasing enthusiasm for downstream enterprises is still relatively stable. For medium and high sulfur petroleum coke, its price stabilized with slight upward movement. Local refineries remained stable, showing price fluctuations driven by limited downstream demand. Average petroleum coke price had slightly dropped to 342 USD/MT. Overall, low sulfur petroleum coke price shows some improvement. Medium and high sulfur petroleum coke remains under pressure and it reflects prudent purchasing behavior from downstream enterprises.

Between June 13 and June 19, petroleum coke price saw a slight increase. However, the overall trading activity remained subdued, with some refineries continuing to reduce low sulfur petroleum coke price despite the general stabilization of the market. The market remained stable and gradual price adjustments as refineries sought to maintain steady stock levels.

The period from June 20 to June 26 marked a more noticeable shift. Low sulfur petroleum coke price seeing a sharp rise due to growing demand for restocking. It driven by both downstream enterprises and supply-side constraints. Refineries buoyed by higher low sulfur petroleum coke price, pushing petroleum coke price up to 350 USD/MT approximately. This trend was further supported by a decrease in imported coke arrivals, leading to a reduction in port inventories. In contrast, medium and high sulfur petroleum coke price continued to follow the low sulfur trend, stabilizing slightly or seeing small increases.

At the end of June 2025, prices remained elevated. Despite this, local refineries showed mixed performance, with some prices adjusting downward as downstream demand softened. The overall market though showing upward movement, continued to be influenced by varying demand levels and supply-side dynamics.

Fig. 1 Average Price

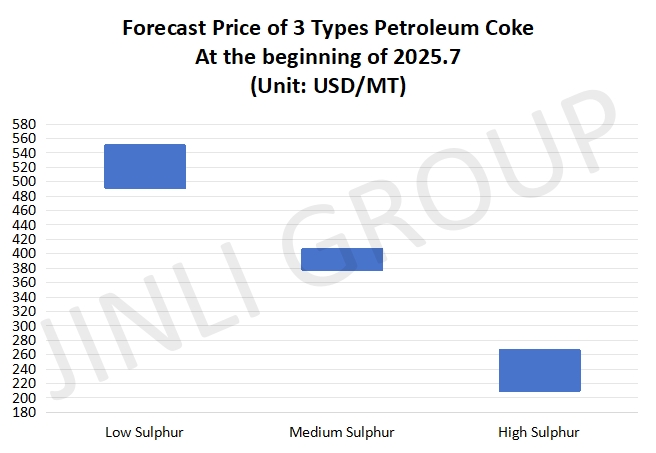

Fig. 2 Forecast Price

Petroleum Coke Price Trend

On supply side, domestic petroleum coke market at the beginning of July 2025 is expected to see a further increase in supply due to the planned restart of three coking units. This increase, along with consistent production from existing refineries, suggests a stable upward trend in domestic supply. Import activity continues to be subdued, with small transactions and limited offloading at ports. As a result, port inventories are expected to rise slightly. While domestic supply is set to increase, the continued sluggish pace of imports will maintain the pressure on overall stock levels, it affects price stability at the beginning of July 2025. Despite this, the supply increase from domestic refineries will help to meet the relatively steady downstream demand, particularly for low sulfur petroleum coke, it ensures market support in the short term.

On demand side, downstream industries such as carbon industry and anode materials are expected to continue their stable demand for petroleum coke. These sectors are not anticipating significant changes in procurement volumes. Meantime, purchasing behavior largely aligned with existing needs. However, graphite electrode market remains weak and the market taking a wait-and-see approach. It leads to limited support for petroleum coke price from this realm. Overall, downstream industries are contributing to steady support for the petroleum coke market, though they are not generating enough momentum to push prices upward significantly.

Conclusion

In summary, petroleum coke market is expected to maintain a stable pricing environment. Not only the steady downstream demand but also continued increase in domestic supply will provide support for the market, particularly in the low sulfur petroleum coke. Notwithstanding the number of port inventories rises slowly, it remains a factor in price restraint, particularly for imported coke. Medium and high sulfur petroleum coke will likely follow the market trend. The expected price ranges are: maximum price for low sulfur petroleum coke will be 550 USD/MT, medium sulfur petroleum coke at 378–405 USD/MT. For high sulfur petroleum coke, its minimum price will be 210 USD/MT approximately. While supply increases are expected to meet demand, the market will remain cautious.

If you have any needs, please contact us without any hesitation!