In July 2025, petroleum coke prices faced moderate shifts, influenced by factors such as production rates, import/export flows and changing demand patterns. This analysis highlights the key drivers behind these price movements, offering a clear view of the current market situation and what might affect prices in the near term.

Petroleum Coke Price Overview

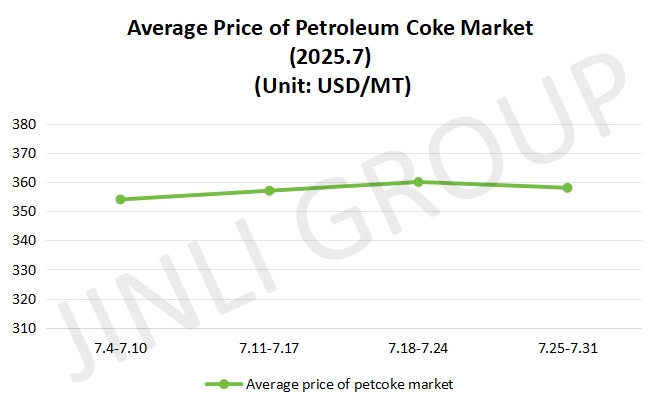

From July 4 to July 10, the petroleum coke market saw a strong increase in prices. Downstream demand for low sulfur petroleum coke rose, pushing prices higher and supporting steady shipments. Medium and high sulfur petroleum coke also saw price increases, driven by demand from the anode material sector. Local refineries had good sales due to low inventory, but some adjusted prices downward to ease delivery pressures. Port stocks were consumed slowly with small transactions dominating. Petroleum coke price in the first week reached about 354 USD/MT. The market remained strong due to steady demand and tight supply.

In the second week of July 2025, the market continued to show positive movement, though at a slower pace. Low sulfur petroleum coke prices remained stable at main refineries, with minor price increases in some auctions. Medium and high sulfur petroleum coke prices also rose due to increased restocking demand. However, some refineries reduced prices due to weaker demand or product quality issues. Local refineries had mixed performance, with prices fluctuating based on supply and demand.

In the third week, price movements were more varied. Main refineries for low sulfur petroleum coke saw prices rise and fall, while medium and high sulfur petroleum coke saw minor adjustments. Local refineries experienced similar trends, with prices shifting based on inventory levels and demand. Port market conditions showed slow stock depletion, with moderate sales for medium and low sulfur petroleum coke, but weak sales for high sulfur petroleum coke. By July 24, the market price increased to 360 USD/MT approximately. The market remained mixed, with regional demand influencing price changes.

Finally, the market showed signs of stabilization. Low sulfur petroleum coke prices continued to rise as a result of strong downstream demand. Medium and high sulfur petroleum coke prices fluctuated based on product quality and order volumes. Local refineries saw similar trends, with varying price movements. Port market conditions remained steady, with low sulfur petroleum coke sales strong and high sulfur petroleum coke lagging. Compared with the last week, the petroleum coke price dropped about 2 USD/MT. The market showed overall stability with regional factors influencing prices.

Fig. 1 Average Price

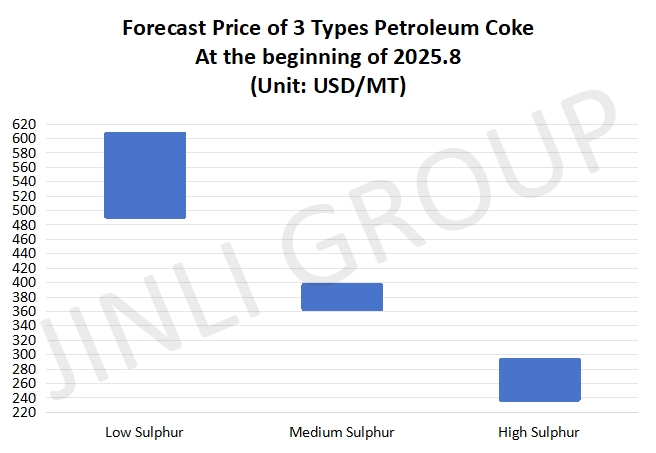

Fig. 2 Forecast Price

Petroleum Coke Price Trend

Next week, three coking units that had previously been shut for maintenance are expected to resume operations. It is conducive for increasing the daily production. Additionally, one unit will undergo scheduled maintenance, which may slightly reduce overall supply. On the whole, domestic petroleum coke supply could see a small increase at the beginning of August 2025. Import shipments will continue in small batches, with port stocks being slowly consumed. As such, there may be a slight reduction in port inventories next week. With these changes, the overall supply of petroleum coke in the market will likely see some fluctuations, driven by both production restarts and gradual consumption of imported stocks.

Downstream demand from carbon industry enterprises is expected to remain steady, with a continued focus on essential purchases. The demand for petroleum coke from the anode material sector is expected to stay stable, maintaining the current pace of orders. The graphite electrode market continues to operate at low production levels, so its demand for raw petroleum coke is unlikely to increase in a short term. Meanwhile, silicon carbide producers are facing limited profit margins, leading to moderate production activity and cautious purchasing of petroleum coke. Overall, the demand side will remain relatively stable, with a few sectors showing only mild growth.

Conclusion

As downstream carbon industry enterprises prepare for replenishment, there is likely to be some increase in petroleum coke purchasing activity. Refineries are holding relatively low to medium stock levels, which could benefit the petroleum coke market. As a result, prices for low sulfur petroleum coke from major refineries may continue to rise, while medium and high sulfur petroleum coke will be sold on an as-needed basis. Local refineries are expected to maintain stable pricing with slight increases. The main price range for petroleum coke is as follows: low sulfur petroleum coke at 490-605 USD/MT approximately. For medium sulfur, its maximum price is about 397 USD/MT. As for high sulfur, 237 USD/MT is its minimum price at the beginning of August 2025.

If you have any needs, please contact us without any hesitation!