In August 2025, petroleum coke prices continued to reflect a dynamic market environment, shaped by ongoing fluctuations in global supply and demand. Several factors, including production adjustments, export/import trends and regional economic conditions, contributed to the price shifts observed during the month. This report breaks down these influencing elements and provides an overview of the current market status, offering insights into potential price trends for the upcoming months based on the current data.

Petroleum Coke Price Overview

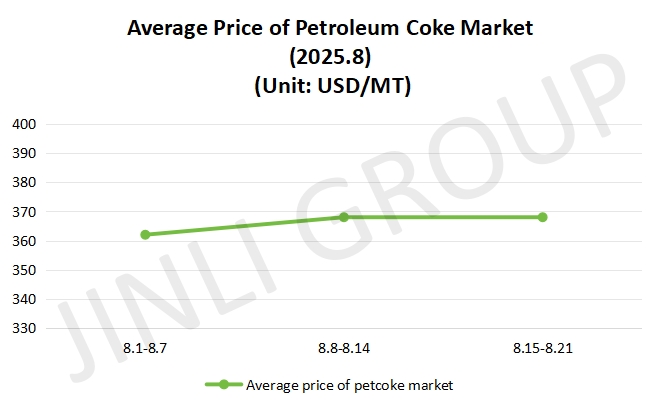

From August 1 to August 7, the petroleum coke market saw strong trading activity, with prices predominantly rising. Low sulfur petroleum coke, driven by supply constraints and strong downstream demand, led the price increases. Several refineries were undergoing maintenance, tightening supply, while ship fuel production plans contributed to the growing demand for low sulfur petroleum coke. On the demand side, downstream buyers took advantage of the beginning-of-month replenishment period, further supporting price hikes. Medium and high sulfur petroleum coke prices followed suit, with some slight increases observed. Local refineries benefited from stronger market sentiment, as they raised prices alongside major refineries, although some saw minor adjustments to remain competitive. The port market showed improvement with reduced inventories and slight price increases. By August 7, the average market price had risen to 362 USD/MT. Overall, the market was buoyed by strong demand, particularly for low sulfur petroleum coke and continued refinery maintenance that further restricted supply.

In the middle of August 2025, the market showed more stable trading conditions. While prices for low sulfur petroleum coke continued to rise, the pace of the increase slowed, as downstream buyers became more cautious about high price orders. The strong performance of low sulfur was supported by ongoing refinery maintenance in northeastern regions and increased ship fuel production. However, demand for medium and high sulfur remained modest, with some refineries adjusting prices upward in response to improving demand. Local refineries experienced slower trading as buyers became more hesitant. The port market saw better sales for sponge coke, influenced by domestic coke prices, while demand for high sulfur remained limited. At the end of this week, the average price reached about 366 USD/MT. Despite continued upward pressure on low sulfur prices, the overall market showed signs of stabilization, with prices reflecting more balanced supply and demand dynamics.

In the end, the petroleum coke market experienced weaker stability. Main refineries maintained prices for low sulfur petroleum coke, though some minor declines were seen in certain areas as downstream demand slowed. Increased environmental controls and the risk of reduced production at some downstream enterprises dampened purchasing sentiment, leading to prudent buying behavior. Refineries, facing the potential for excess inventory, were more inclined to actively sell, which put downward pressure on prices. Medium and high sulfur petroleum coke prices were relatively stable, with a few refineries continuing to adjust prices upward as demand remained steady. Local refineries saw mixed results, with some low and medium sulfur petroleum coke prices falling due to weaker demand. The import market slowed, with small transactions dominating. The market price held steady at 366 USD/MT approximately, showing no change from the previous week. The market, while stable, was marked by a shift towards more cautious buying behavior and restrained trading activity.

Fig. 1 Average Price

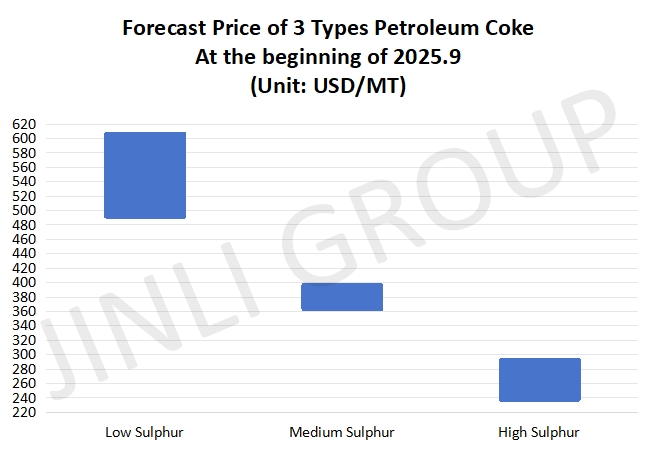

Fig. 2 Forecast Price

Petroleum Coke Price Trend

For supply side, it is expected that one coking unit will be shut down for maintenance, while another will resume normal operations, resulting in a slight increase in domestic petroleum coke supply. Furthermore, as a number of refineries gradually return to production, it is anticipated that the overall supply of domestic petroleum coke will increase. On the import side, traders have been actively moving products. And port inventories are continuing to be depleted. This indicates that there is a high possibility of a further reduction in port stocks in the upcoming week. The supply dynamics suggest a slight uptick in availability, but this will be tempered by ongoing maintenance and the adjustment of refinery operations. As the overall market supply increases, it may create some pressure on pricing, particularly if demand does not show significant growth.

Demand from downstream sectors, such as carbon industry and anode materials industry, is expected to remain stable. These industries are continuing with their standard purchasing processes, providing steady support to the petroleum coke market. However, the graphite electrode market remains subdued, with inquiries still present but overall demand staying low, limiting the purchase of petroleum coke. The silicon carbide market continues to perform weakly and there is no clear improvement in the near term. Most enterprises in this sector are operating on a just-in-time basis, maintaining a cautious approach toward procurement. This results in generally moderate demand for petroleum coke across these industries. Given the lack of significant uptick in demand from key sectors, the market’s overall strength will likely remain limited, with only moderate support for pricing.

Conclusion

Looking ahead to the beginning of September 2025, overall production and demand are expected to remain stable, with downstream industries maintaining their purchasing pace based on actual needs. This will provide some support to the petroleum coke market, but the return of refineries to production could increase the overall supply of domestic petroleum coke, which may put some downward pressure on prices. As such, low sulfur petroleum coke prices are likely to remain stable, with minor fluctuations around the current levels. Meanwhile, local refinery prices for petroleum coke will likely see a steady to slightly narrow range of adjustments. The expected price range for petroleum coke is showed in figure 2 and it is as follows: low sulfur petroleum coke is expected to trade between 495-605 USD/MT, medium sulfur petroleum coke’s maximum price is about 405 USD/MT. As for high sulfur petroleum coke, its minimum price is 245 USD/MT approximately. These price expectations suggest a relatively stable but prudent outlook for the petroleum coke market in the near future.

If you have any needs, please contact us without any hesitaiton!