September 2025 saw continued fluctuations in petroleum coke prices, driven by shifting demand in key industries, supply chain constraints and economic developments. As market conditions evolved, production levels and international trade flows played a significant role in influencing pricing trends. This analysis provides an in-depth look at the factors impacting the petroleum coke market this month, offering a clear understanding of the current price landscape and forecasting potential trends for the coming period.

Petroleum Coke Price Overview

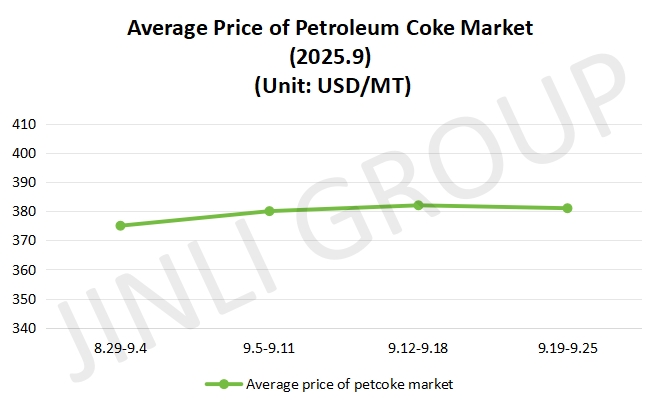

The petroleum coke market saw a strong trading performance in early September, driven by active downstream procurement and a favorable supply-demand balance. From August 29 to September 4, prices saw a significant increase, particularly for low sulfur coke, which was bolstered by tight inventory at main refineries. As carbon producers and anode material manufacturers ramped up their procurement at the beginning of month, the market was further supported by strong demand. Similarly, mid and high sulfur petroleum coke followed the upward trend, reflecting the overall positive market sentiment. Local refineries adjusted their prices upwards due to the strengthened position of major refineries, with good procurement activity from downstream clients. Additionally, the import market also showed signs of recovery, with sponge coke shipments increasing and continued depletion of port inventories. The price for petroleum coke in this period rose by about 1.5%, reflecting the overall bullish trend. The second period in September 2025 followed a similar trajectory, with steady demand for low sulfur petroleum coke due to ongoing procurement from anode material producers. Import coke also benefited from the price hikes of domestic coke, with sponge coke prices showing a slight increase. However, while the market was strong, some caution was seen in the mid and high sulfur grades, where demand growth remained subdued and prices saw only a slight increase. Both periods saw active market movements driven by stock replenishment at the beginning of month and strong upstream price adjustments, maintaining the upward momentum in petroleum coke prices.

As September progressed, market dynamics began to show some divergence, especially with the approach of the National Day holiday in China. In the third week of September 2025, the market exhibited mixed price movements, with low sulfur coke seeing some downward pressure as refineries cleared stock ahead of the holiday, resulting in small price adjustments. Despite this, overall demand remained healthy, with steady shipments and general price increases for mid and high sulfur coke as demand from downstream sectors remained steady. Local refineries saw a weaker performance as many experienced fluctuating quality indicators, which led to a more cautious market approach and weaker price action. On the import side, demand for low sulfur petroleum coke remained stable and high sulfur petroleum coke saw slower movement. At the end of September, the market’s behavior became more segmented. Refineries adjusted their prices due to increasing stockpiling in anticipation of the holiday, leading to price fluctuations. The low sulfur market, in particular, remained active, supported by ongoing procurement from downstream sectors. However, mid and high sulfur grades were more stable, with minor price movements. Local refineries continued to face mixed market conditions, with some experiencing downward pressure while others were able to increase their prices. Overall, the second half of September saw mixed results, with steady support from low sulfur coke markets, but uncertainty remained in the high sulfur segment. Despite fluctuations in individual grades, the general price trend in September was largely stable, with slight adjustments on both ends.

Fig. 1 Average Price

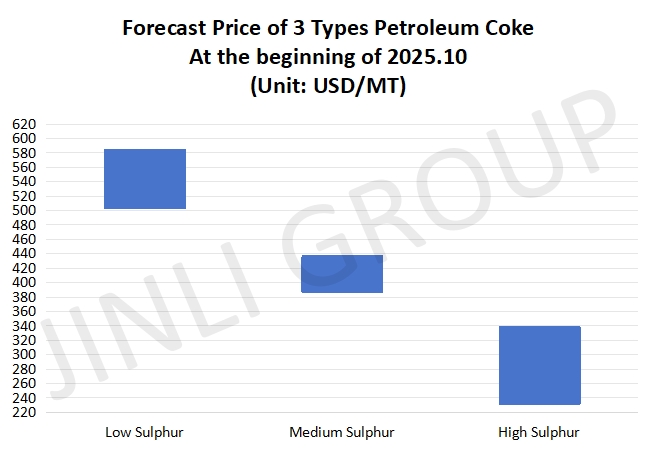

Fig. 2 Forecast Price

Petroleum Coke Price Trend

At the beginning of October 2025, on the import side, port shipments remain steady, although the quantity arriving is expected to be lower. Consequently, port inventories are expected to continue decreasing. The market is closely monitoring the balance between domestic and import supply, as the reduced import volume may help maintain a slight upward trend in local market prices, supporting the overall stability of petroleum coke supply.

Downstream demand from aluminum carbon material and anode material producers is expected to remain stable, with a moderate level of stockpiling activity. This ongoing procurement ensures a steady demand for petroleum coke, supporting the market in the near term. The silicon carbide market is expected to remain stable, with limited changes in demand for petroleum coke. Similarly, the graphite electrode market is experiencing minimal fluctuations and the procurement of petroleum coke by these industries is unlikely to see significant changes. Overall, demand for petroleum coke will largely stay consistent, with small variations influenced by the specific needs of these downstream sectors.

Conclusion

At the beginning of October 2025, the market is likely to experience moderate price stability as the National Day holiday approaches. While some refineries may fulfill holiday orders, the demand from downstream sectors remains steady. As a result, major refineries are expected to maintain stable petroleum coke prices, with potential for small price increases for certain grades. Local refineries are also expected to stabilize, with some small adjustments in prices based on market fluctuations. The anticipated price range for petroleum coke is as follows: low sulfur petroleum coke is expected to trade at 504-584 USD/MT, for mid sulfur, its maximum price is about 436 USD/MT. As for high sulfur petroleum coke, its minimum price is 232 USD/MT approximately. The overall market outlook indicates a stable trend with modest upward or downward adjustments.

If you have any needs, please contact us without any hesitation!