In January 2026, petroleum coke prices are shaped by ongoing shifts in demand, supply chain factors and global economic conditions. This analysis examines the key elements driving price changes this month and offers a concise overview of the market’s current status and potential trends for the near future.

Petroleum Coke Price Overview

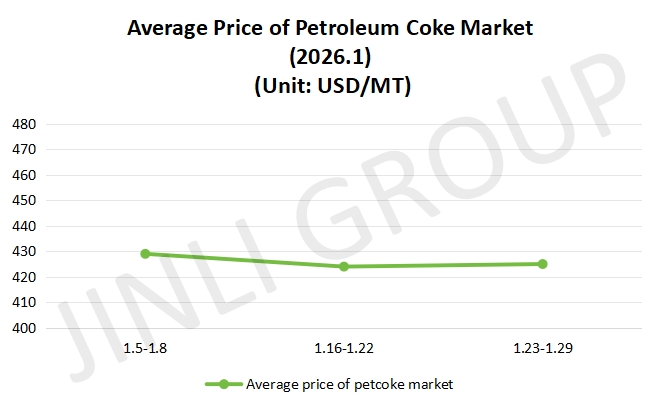

In the first half of January 2026, the petroleum coke market showed a positive trading atmosphere, with downstream demand from sectors like anode materials and carbon products picking up. Major refineries saw steady orders for low sulfur coke, with some prices rising due to increased competition for supply. High and medium sulfur coke prices remained relatively stable, with minor fluctuations based on quality indicators and shipment volumes. Local refineries were actively moving their stocks, with downstream demand providing solid support for prices. Additionally, refinery inventory levels were generally low, further supporting price increases. The import market showed signs of improvement, with port-based petroleum coke trading briskly. High sulfur petroleum coke saw steady transactions, while geopolitical factors played a role in boosting Venezuelan petroleum coke prices slightly.

In the second half, petroleum coke market experienced more stability in trading, with minor price changes across different grades. Low sulfur petroleum coke from major refineries remained in demand, with inventory levels still relatively low, supporting price stability. However, some low sulfur petroleum coke saw price declines as quality indicators worsened, reflecting a slight decrease in demand for specific products. Medium and high sulfur petroleum coke followed the general trend, with prices largely stable and sales occurring on an as-needed basis. The demand for anode materials remained steady, contributing to the firmness in prices for these specific grades. Local refineries saw a brief price increase followed by a decline as the month progressed. After earlier price drops, downstream buyers entered the market to replenish stocks, providing upward support for prices. However, as the end of the month approached, purchasing activity slowed, particularly as refineries focused on clearing inventory before the Chinese Spring Festival holiday.

Fig. 1 Average Price

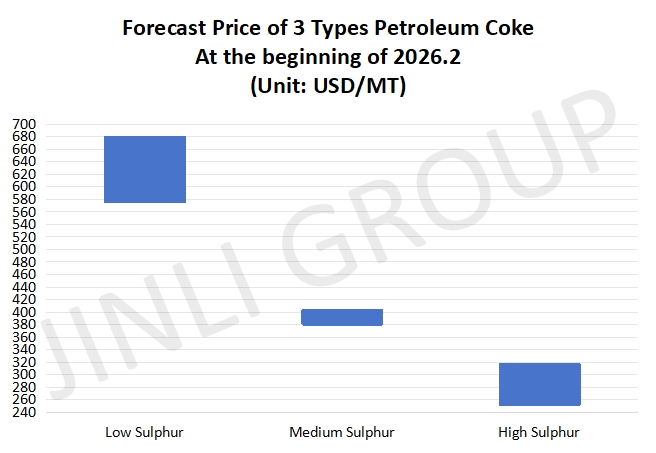

Fig. 2 Forecast Price

Petroleum Coke Price Trend

From the supply perspective, the domestic petroleum coke market is expected to remain relatively stable at the beginning of February 2026. According to the information, domestic petroleum coke output is unlikely to see significant changes. This stability on the production side limits the possibility of sharp fluctuations in the petroleum coke price driven by supply shocks. In the import market, downstream buyers continue to adopt a cautious procurement strategy, which has slowed the pace of port inventory digestion. Although current port inventories are still being consumed at a moderate rate, the lack of aggressive buying suggests that inventory pressure may gradually ease rather than accumulate. As a result, imported petroleum coke supply is expected to show a slight tightening trend, providing marginal support to the overall petroleum coke price, especially for certain low sulfur grades.

On the demand side, downstream performance remains generally steady but lacks strong growth momentum. The carbon sector continues to operate at stable rates, offering basic support to the petroleum coke price through routine procurement. Anode material producers are largely maintaining steady shipment rhythms and their raw material purchasing is expected to remain stable rather than expand. The graphite electrode sector is also relatively calm, with most producers focused on fulfilling existing orders instead of building new inventories. Overall, downstream demand provides only essential support, with limited capacity to drive petroleum coke price increases in the short term.

Conclusion

The petroleum coke market is expected to operate within a narrow range. Supply-side conditions are largely unchanged, while downstream demand remains stable but conservative, resulting in limited support for further petroleum coke price appreciation. Low sulfur petroleum coke prices from major refineries are expected to remain firm, supported by stable contracts and controlled supply. The main price range for petroleum coke is as follows: low sulfur petroleum coke is expected to trade at 576-679 USD/MT; for medium sulfur petroleum coke, its maximum price is about 403 USD/MT; as for high sulfur petroleum coke, its minimum price is 252 USD/MT approximately. Overall, the petroleum coke price trend is expected to remain stable with localized adjustments.

If you have any needs, please contact us without any hesitation!