Petroleum Coke Market Overview

As we enter 2025, 2024 comes to a perfect end. Now, it is the time to conclude the petroleum coke market in 2024. Let’s have a look.

Retrospecting the petcoke market in 2024, its price fluctuated at low level and the trend looks like the letter “N”.

Compared with the last year, supply of petroleum coke is not enough, embodying in imported coke. Whereas, for demand side, some downstream enterprises like anode material and carbon industry have a lasting and strong purchasing enthusiasm for sponge coke. And different petroleum coke have a divergent trend.

Petroleum Coke Price

For low sulfur petroleum coke, its price fluctuated in wide range. The reason why it fluctuated in wide range is that the game between domestic supply and demand for some downstream enterprises, such as carbon industry, anode material and so on.

At the end of 2024, as the inventory reduced and supply-demand relationship improved, low sulfur petroleum coke price increased gradually.

For medium and high sulfur petroleum coke, there was a divergent trend.

At the end of 2023 and the beginning of 2024, downstream enterprises, like carbon industry, replenished their inventories with strong purchasing enthusiasm, because petroleum coke price hit the temporary rock bottom at that moment. It pushed medium and high sulfur petroleum coke price up rapidly.

In the middle of 2024, some local refineries procured low price crude to produce. In general, as we all know, raw material quality impacts on the finished product quality indirectly. In addition, carbon industry had a meagre profit and it is difficult for refineries to sell their products. Hence, price fell gradually.

At the end of 2024, low sulfur petroleum coke price climbed, thereby, it made the market shipment improved. What’s more, it also drove medium and high sulfur petroleum coke price up.

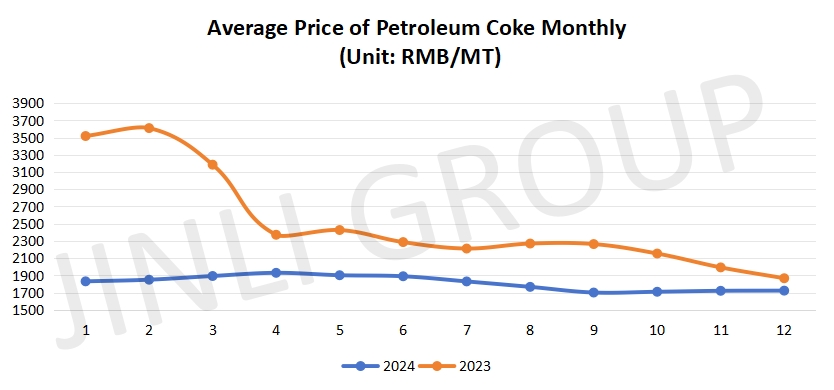

From the figure, we can see the petroleum coke price comparison of 2023 and 2024. The price fluctuation in 2024 is very small, compared with 2023. In the first half, price at a relative high level. While, in the second half, price dropped slightly and maintains around 1740 CNY/MT.

Petroleum Coke Market Outlook

From supply side, low and medium sulfur petroleum coke production will not change a lot in 2025 for main refineries. Notwithstanding main refinery production will be stable, it do not affect the local refinery. Some local refineries will enhance the production slightly in 2025, such as Urumqi Petrochemical and so on.

In conclusion, in 2025, it will have a slight ascending trend for supply.

From demand side, different downstream enterprises have a different trend. For graphite electrode, silicon metal and other industry, it will be decreased slightly. While, for anode material industry, silicon carbide and carbon industry, it will be another scene.

Besides, some local policies will be also affect the demand. For example, southern fuel market will be affected by policies.

Actually, exchange rate can also affect the price indirectly.

As we all know, Donald Trump won the 2024 US Presidential Election. As the presidential term is about to begin, exchange rate between USD and CNY will rise continuously. It affects the price more or less.

In conclusion, it is possible for low and medium sulfur petroleum coke price to increase slightly. However, it will be stable at low level for high sulfur.

Price for low and medium sulfur petroleum coke is no more than 4000 CNY/MT. And 900 CNY/MT is minimum price for high sulfur petroleum coke in 2025.

If you have any needs, please contact us without any hesitation!