Exploring the fourth quarter of 2023, this analysis dissects the price dynamics of petroleum coke. Unraveling the factors that influenced costs, we aim to provide a straightforward overview of market shifts during this period.

Analyze Market Overview

In the forth quarter, price for petroleum coke decreased gradually and not only petroleum coke market but also global economic situation performs weakly unceasingly.

During the whole forth quarter of 2023, many incidents happened and affected price for petroleum coke more or less. For example, PRC chairman Xi flied to America and visited US president Biden, it makes exchange rate between USD and RMB drop. Meanwhile, it also caused price for petcoke down indirectly. Besides, Israeli-Palestinian conflict persists, Houthi force in Yemen attacked all ships that related to Israel. And most of merchant ships had to detour, it led to low demand for Europe. And then, the rest of petcoke in stock is more and more, finally, price for petcoke downed successively. Thus, these factors affect price. Frankly speaking, actually, other factors also affect price, such as purchase enthusiasm for downstream enterprises, demand, stock, etc.

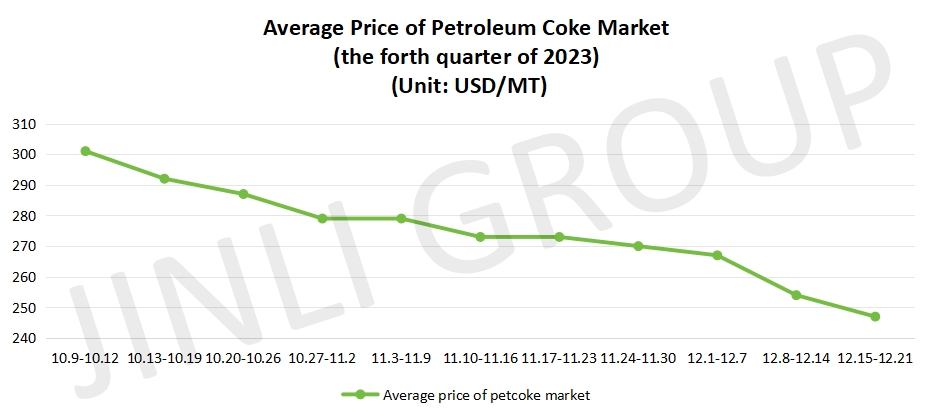

Fig.1 is price trend for petroleum coke in the whole forth quarter of 2023. From this figure, we can see clearly that price decreased steadily. The value of petroleum coke declined by more than 17%. Including, slope is lower than other times at the beginning of December 2023, due to slope is negative. Nevertheless, in the middle and ending of November 2023, it is smoother than others relatively.

Fig. 1 Price trend chart for petroleum coke

Conclusion

In summary, our examination of the fourth quarter of 2023 sheds light on the nuanced elements shaping petroleum coke prices. With a focus on practical insights, this analysis equips industry stakeholders to navigate the market with a clearer understanding.